By Elisabeth Lang, eTN | Feb 05, 2012

(eTN) – The EU is Turkey’s number one trade partner, with Turkish exports and imports between 46 to 39 percent. Foreign direct investment inflows to Turkey amounted to €10 Billion in 2008, while Turkish direct investments in more than 50 countries amounted to €1.7 billion, said Turkish Chief Negotiator and Minister for European Union Affairs, Egeman Bagis, in Munich last month.

(eTN) – The EU is Turkey’s number one trade partner, with Turkish exports and imports between 46 to 39 percent. Foreign direct investment inflows to Turkey amounted to €10 Billion in 2008, while Turkish direct investments in more than 50 countries amounted to €1.7 billion, said Turkish Chief Negotiator and Minister for European Union Affairs, Egeman Bagis, in Munich last month.

Turkey is the key to Europe’s future. Turkey has a unique strategic position in its region for geographical, cultural, and historical reasons. It is the most Eastern part of the West and the most Western part of the East.

Minister Bagis also sees Turkey as an active player and mediator in critical areas such as the Middle East, South Caucasus, Central Asia, the Black Sea basin, the Mediteranean, and the Balkans. When asked by Alison Smale, Executive Editor of the International Herald Tribune, he said, “Turkey is the only country to apply for a Schengen visa. That Turkey will join the EU is a 60 percent issue.”

With Europe on one side and Asia on the other side, Turkish investors are looking more into the Central Asia region and its 1.4 billion consumers, than to Europe.

Established and very well connected, Turkish hotel investors, construction companies, and developers have been heading to Central Asia for years, building partnerships with neighbor countries in the south – Georgia, Armenia, Azerbaijan, Syria, Iraq, and Iran – at the bottom line.

The country – straddling the continents of Europe and Asia – is a promising market, with Istanbul as one of the world’s hottest destinations and one the hippest cities. Istanbul’s sights and sounds are beyond compare, believes Romain Avril, Vice President of Business Development for Rezidor. He sees a big potential in mid-market hotels. Why is that? Lack of competition, low cost of operation, quick turnaround, and simpler development and construction procedures makes Istanbul, Turkey very attractive segments to move business to.

Until now, Radisson Blue has four properties in operation (Istanbul Bospherus, Istanbul Airport, Ankara, and Cesme), and four new hotels are under development in Istanbul Asia, Istanbul Sisli, and Istanbul Golden Horn, with more to come. Envisioning 5-6 Park Inns by Radisson hotels (maybe as part of a joint venture) in Istanbul city, with another 10-20 hotels in the pipeline in other cities, such as Izmir, Mersin, Bursa, etc., makes Radisson more or less a local player with strong Turkish partners.

“The outlook of the Turkish tourism industry is more buoyant than ever, with an increasing number of international and local hotel companies investing in the sector,” said Jonathan Worsley, Chairman of Bench Events, co-organizer of the Central Asia and Turkey Hotel Investment Conference (CATHIC), to be held in Istanbul from February 6-8, 2012.

It is the ideal time to invest in Turkey’s hospitality sector with international tourist arrivals expected to reach 33 million by 2012. Indeed, more than 1.4 million Arab visitors are recorded so far this year.

The conference program includes speakers with knowledge and expertise in regional and international hotel development, finance, hotel branding and operations, plus sessions giving perspectives from industry analysts.

Among key speakers of CATHIC 2012 is Cevdet Akcay, Chief Economist;Yapi Kredi Bank; Denis Hennequin, President & CEO, ACCOR SA; Eric Danziger, President & Chief Executive Officer, Wyndham Hotel Group; Kurt Ritter, President & CEO, The Rezidor Hotel Group; Atilla Ozturk, CEO & Board Member, ASTAY; Serdar Bilgili, Chairman, Bilgili Holding; and Roland Vos, President, EAME, Starwood Hotels & Resorts Worldwide, just to name a few.

Meanwhile, Mehmet Önkal, Managing Partner, BDO Hospitality Consulting in Turkey, warned that investment in the sector is crucial. “One of the key drivers of sustainable development is the consistent flow of investment, and Turkey is lucky, as it does not face the same challenges with financing as other markets.” he said.

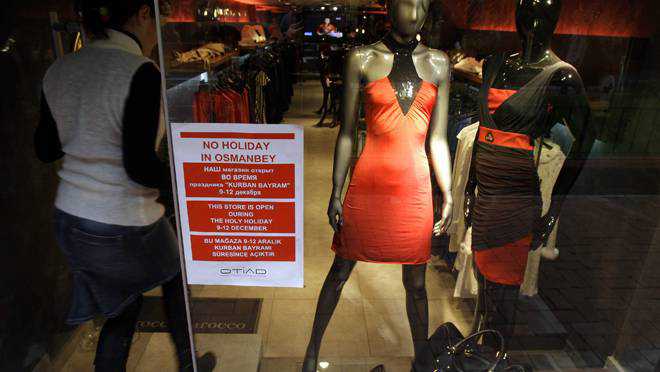

And last but not least, Turkey’s tourism industry has also benefitted from ongoing unrest in Egypt and the North Africa region. Among Turkey’s visitors were a number of newcomers – Arab tourists, for instance, who used to travel to Syria and nearby, are discovering Istanbul – strongly attracted by the wide array of mosques and similar hospitality.

With more and more arrivals coming from the UK, the ABTA Travel Convention is returning to Turkey this year in October. The last time Turkey hosted the ABTA Travel Convention was in 1996 in Istanbul. At that time, the country had just over 750,000 arrivals from the UK, which today is closer to 3million.

Turkey has also launched Istanbul’s bid to host the 2020 Olympic Games. In support of that, Istanbul is hoping to strengthen the bid as the 2012 European Capital of Sports. Events highlighted will include the IAAF World Indoor Championships in Athletics (March 9-12, 2012), which is likely to be the final opportunity to see athletes competing on an international level prior to the London Summer Olympics 2012.

via Number one trade partner in EU is Turkey Turkey: the key to Europe’s future – eTurboNews.com.