By Daniel Dombey | Financial Times, Published: March 12

ISTANBUL — The Americans won the war, the Iranians won the peace and the Turks won the contracts.

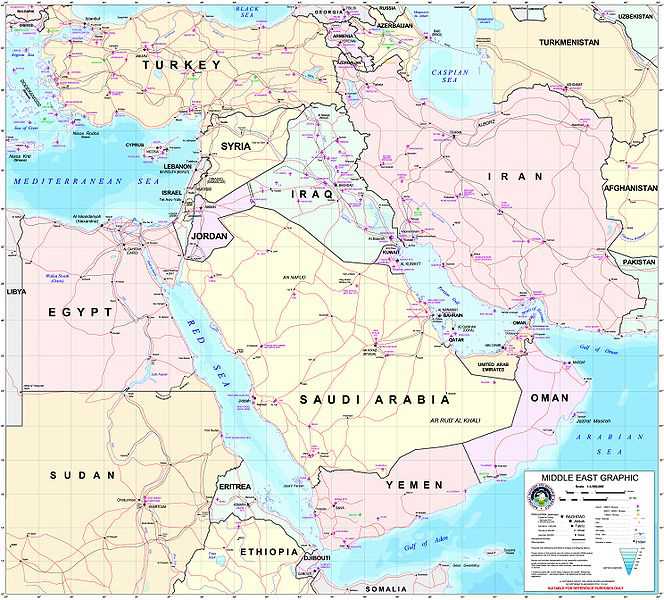

Turkey, which blocked the deployment of U.S. troops through its territory during the 2003 invasion that toppled Saddam Hussein, is emerging 10 years on as one of the prime beneficiaries of the battle for the Iraqi market.

Although Turkey’s relations with Baghdad are increasingly bitter, its exports to Iraq have in the past decade soared by more than 25 percent a year, reaching $10.8 billion in 2012, making Iraq Ankara’s second-most valuable export market after Germany.

Ozgur Altug, an economist at BGC Partners in Istanbul, predicts that as Iraq grows richer because of its oil reserves, demand for Turkish goods will keep climbing — by more than $2 billion a year. Turkish contractors have also been doing rich business, working on about $3.5 billion of construction projects last year, according to businessmen and officials.

One company, Calik Energy, boasts that it is building the two biggest projects in the Iraqi power sector, two gas turbine plants in the Mosul and Karbala regions, earning more than $800 million from the Iraqi government in the process.

While Iran is seen as the most influential outside power in Iraq today, on Baghdad’s streets Turkey’s presence is more visible than that of any other country, with everything from malls to furniture stores to pavement bricks bearing a Turkish trademark.

But it is the Kurdish-governed north that accounts for the bulk of Turkey’s business, absorbing about 70 percent of Turkey’s exports to Iraq. In contrast, Ankara’s relationship with the rest of the country is becoming more poisonous, with political disputes leading Baghdad to hold back on giving new government contracts to Turkish groups.

As Ankara’s economic and diplomatic ties with the Kurdish government expand, about 1,000 Turkish businesses are working in the north, including some of Turkey’s best known banks, retailers and hotels.

Hundreds of trucks a day clog up the land border between northern Iraq and Turkey as a flow of goods makes the journey to Kurdish markets. Turkish products dominate the regional capital of Irbil, from the old covered souk to modern showrooms in residential neighborhoods.

Less obtrusively, other groups are carving out markets for themselves. From his base in the southern Turkish city of Gaziantep, Adnan Altunkaya says his family-owned company commands two-thirds of the Iraqi diaper sector.

Sales to the country account for 90 percent of the Altunkaya group’s annual $400 million exports and have been rising by 50 to 60 percent a year for the past two years. It has also just taken the leading position in the Iraqi olive market.

“Our business with Iraq is increasing constantly,” he says. “But of course it is affected by political tension.”

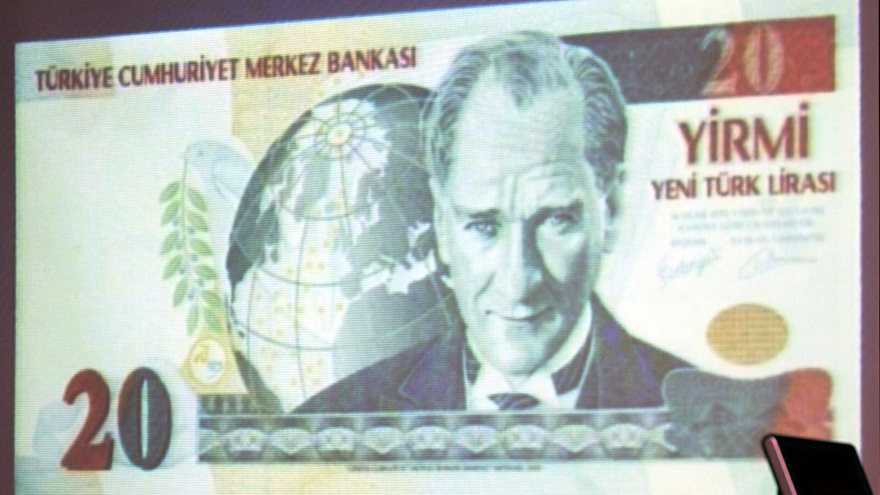

In large part, the success story represents Turkey’s return to its natural market, from which it was shut out since the 1980s by war, sanctions and instability. As a neighboring state with an industrial base, rich agricultural heartlands and businessmen undaunted by challenging environments, Turkey has advantages others find hard to match.

via Turkey is economic winner of Iraq war – The Washington Post.

more : http://www.washingtonpost.com/world/middle_east/turkey-is-economic-winner-of-iraq-war/2013/03/12/ec046746-8b47-11e2-9f54-f3fdd70acad2_story.html