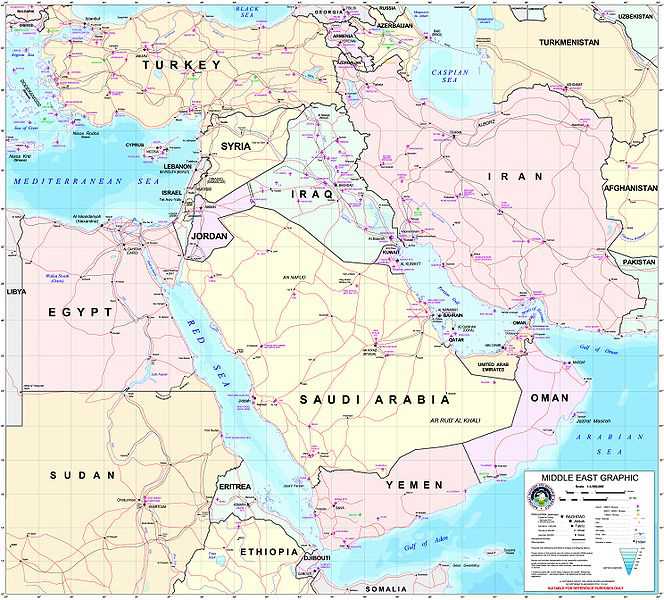

Turkey’s refiner Tupras has urged the country’s statistics agency to stop divulging details of its oil imports from Iran amid US sanctions on Tehran’s oil sector over its nuclear energy program.

The Turkish Statistical Institute (TUIK) stopped detailing its oil imports in late December and released only figures for total monthly imports.

“Tupras asked us last month not to reveal the origin of our crude oil imports and instead give an overall figure,” a TUIK official said, requesting anonymity.

“We were not informed of the reason for the change in policy,” he said.

Tupras officials and TUIK declined to comment on the issue.

Before the change in policy, Tupras had received two Iranian crude cargoes of 145,000 tons and one of 140,000 tons at the Tutunciftlik import terminal.

At the beginning of 2012, the US and the European Union imposed new sanctions on Iran’s oil and financial sectors with the goal of preventing other countries from purchasing Iranian oil and conducting transactions with the Central Bank of Iran.

On October 15, 2012, the EU foreign ministers reached an agreement on another round of sanctions against Iran.

The United States granted 180-day waivers on Iran oil sanctions to Turkey on December 7, 2012.

The illegal US-engineered sanctions were imposed based on the unfounded accusation that Iran is pursuing non-civilian objectives in its nuclear energy program.

Iran rejects the allegations, arguing that as a committed signatory to the Non-Proliferation Treaty and a member of the International Atomic Energy Agency, it has the right to use nuclear technology for peaceful purposes.

SF/AZ/MA

via PressTV – Turkey stops publishing details of oil imports from Iran.