Turkey’s agreement to import lower- cost oil and gas from Iraq’s Kurdish region could help Prime Minister Recep Tayyip Erdogan cut the nation’s current-account deficit by more than a third.

Erdogan and Iraqi Kurdish Prime Minister Nechirvan Barzani signed an accord last month to pipe oil and gas from the region to Turkey, two people with knowledge of the matter said. The deal may help lower Turkey’s borrowing costs through easing the deficit by as much as $17 billion by 2018, according to Ozgur Altug, chief economist at BGC Partners Istanbul unit.

Turkey’s imports of oil and gas, which amounted to $60 billion in 2012, were the main cause of its $47.5 billion current-account deficit last year, the world’s third-largest. The deal would give it access to lower-cost energy in exchange for infrastructure investment and grant Iraqi Kurds direct access to Western energy markets. Iraq’s government hasn’t approved the agreement and says any accord without its consent is illegal.

“That deal is likely to trigger additional rating upgrades and therefore cause more fund inflows to Turkey as it will narrow bond spreads,” Altug said in e-mailed comments on April 22. Turkey’s current-account deficit will improve by more than one percentage point as a proportion of GDP after 2015 because of the agreement, falling below 5 percent from 2016, he said. That compares with 6 percent last year.

Ratings Outlook

Turkey’s two-year note yields have fallen 400 basis points over the past year, the most among 19 major emerging markets tracked by Bloomberg. The yield was 5.45 percent today, the lowest since at least 2005. That’s still the fourth-highest among that group of countries.

Fitch Ratings raised Turkey to investment grade in November, the country’s first such ranking in 18 years. The deficit is Turkey’s “key weakness” and a balance of payments crisis could trigger ratings action against it, Fitch senior director Paul Rawkins said at a conference in London on March 7.

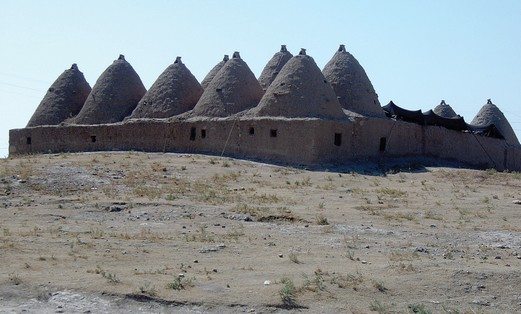

Iraq’s Kurdish region plans to sell oil and gas directly through an extension to an existing pipeline, which carries oil from fields in Kirkuk to the Turkish Mediterranean port of Ceyhan. That arrangement also bypassed the Iraqi authorities, who have warned the Kurds not to sign separate energy accords. Turkey may also take over the Kurdish government’s stake in concessions operated by Exxon Mobil Corp. (XOM) on the enclave’s border with the rest of Iraq, according to one of the people, who asked not to be identified because the plans are private.

Gas Exploration

A potential gas deal with Iraqi Kurds may be more significant than any oil agreement as Iraqi gas is estimated to be about 40 percent less expensive than gas from Turkey’s main supplier Russia, according to Turker Hamzaoglu, an economist at Bank of America Merrill Lynch in London.

“The most exciting part of this partnership concerns the concessions for oil and gas exploration for Turks, but there are no details on that yet,” Hamzaoglu said in an e-mailed report dated yesterday. The infrastructure for the oil and gas transportation to Turkey could be built by 2015-2016 “provided politics do not get in the way,” he said.

The Kurdistan Regional Government in northern Iraq signed its own production agreements with companies including Genel Enerji AS (GENL), an Ankara-based company started by former BP Plc (BP/) Chief Executive Officer Tony Hayward, and DNO International ASA (DNO) of Norway. Genel has been sending oil to Turkey on trucks, Hayward said Jan. 18.

Oil Imports

Turkey imported 3.8 million metric tons of crude oil from central Iraq in 2012, up from 3.1 million tons the previous year, according to Tupras Turkiye Petrol Rafinerileri AS (TUPRS), the country’s sole refiner, which is owned by Koc Holding AS. (KCHOL) Altug predicts oil imports from Iraq will reach 11.8 million tons in 2018 as Tupras forecasts Turkey’s demand for petroleum products will climb to 35.7 million tons in 2020 from 32 million last year.

Last week Turkish central bank Governor Erdem Basci cut the country’s three main interest rates by 50 basis points each, reducing the one-week repo rate to 5 percent, the first reduction since December. The bank’s monetary tightening last year, meant to tame a widening current-account deficit, depressed domestic demand and reduced the nation’s growth rate to 2.2 percent, the slowest pace since a recession in 2009.

Five-year credit-default swaps to protect against a Turkish debt default fell one basis point to 122 today. That compares with 139 basis points for Russia and 167 for South Africa, both of which have higher credit ratings than Turkey, and was down seven basis points from 127 on Turkish swaps at the end of last year.

via Kurds’ Oil Skirting Baghdad Offers Deficit Buster: Turkey Credit – Businessweek.