Wärtsilä strengthens its presence in Turkey with another major power plant order

* Reuters is not responsible for the content in this press release.

Wed Oct 12, 2011 6:15am EDT

Wärtsilä Corporation, Trade &Technical Press release, 12 October 2011

Wärtsilä Corporation, Trade &Technical Press release, 12 October 2011

Wärtsilä is a major supplier of electrical generating capacity to Turkey with more than 3 GW of output either in operation or awaiting installation. Approximately 85 percent of these plants are running on natural gas.

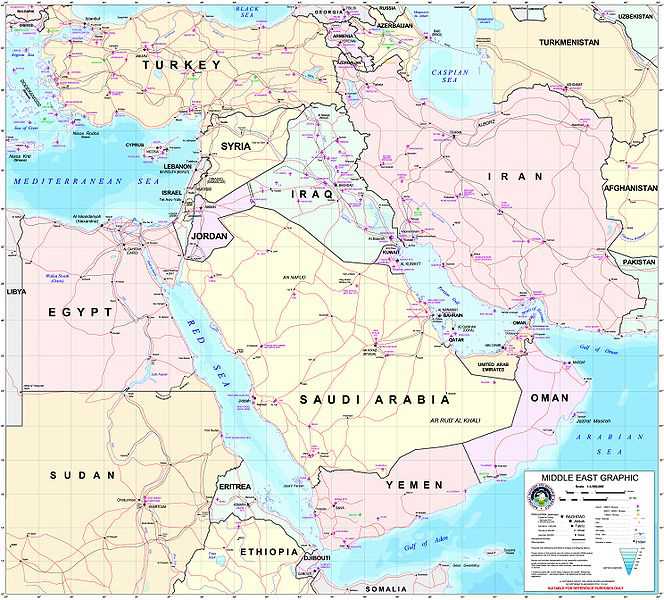

Wärtsilä, a leading global supplier of flexible power plants and services to the power generation market, has received a major order for a power plant to be installed in Turkey. The contract has been placed by Yesilyurt Enerji Elektrik Uretim A.S., an independent power producer (IPP).The power plant will supply electricity for the company’s steel mill in Samsun, on the Black Sea coast of Turkey. Any surplus energy generated by the plant, will be sold to the national grid.

The intermediate load power plant is expected to be running for more than 6000 hours per year, and will feature eight 18-cylinder Wärtsilä 50SG engines running on natural gas. The output will be more than 145 MW. However, together with a steam turbine in combined cycle operation, the output will reach 160 MW at full load. The plant is scheduled to be operational by October 2012. The order is included in Wärtsilä’s third quarter order book.

The 18-cylinder Wärtsilä 50SG spark-ignited gas engine is the largest gas powered combustion engine generating set in the world. It reaches an exceptionally high net efficiency rating of more than 50 percent in combined cycle mode. The engine was introduced in the latter part of 2010, and the very first installation was also in Turkey.

Samsun lies on Turkey’s Black Sea coast and is an area where environmental conservation is considered to be of prime importance. For this reason, an Environmental Impact Assessment (EIA) ‘A’ category certificate was required before the power plant project could be approved. The Wärtsilä 50SG gas engines, which feature very low levels of nitrogen oxide (NOx) emissions, fulfilled all the requirements of this ‘A’ category certification.

“This power plant will demand fast start-ups and shut-downs with high part-load efficiency. Wärtsilä’s technology is well proven and fully capable of meeting these requirements. High efficiency with a minimal environmental footprint were prime considerations in designing this project,” says Hikmet Yesilyurt, Executive Member of the Board, Yesilyurt Enerji Elektrik Uretim A.S.

“Wärtsilä’s already strong presence in Turkey is further enhanced with this important order. Smart Power Generation is a key element in meeting the needs of today’s energy markets, and our broad portfolio of gas and dual-fuel engines is central to this concept. We have an unmatched track record in Turkey, and this together with the local sales and service support that we provide, was a major reason for our being awarded this contract,” says Ufuk Berk, Managing Director of Wärtsilä in Turkey.

Wärtsilä has been present in Turkey since 1994 when the first units were delivered. Today, some 330 Wärtsilä engines are already in operation or awaiting installation, producing well in excess of 3 GW of generating capacity. Customers are supported with a strong local sales and service organisation. Wärtsilä operates from two locations in Turkey and employs 128 people. A third service workshop is planned to be opened early in 2012, and this will increase the number of personnel to around 160.

Smart Power Generation

Wärtsilä has pioneered a Smart Power Generation approach to meeting the future needs of the global energy market. In order to provide a reliable and secure delivery of electricity and to balance supply with demand, flexibility in fuel choice and operational requirements is essential. Wärtsilä is a market leader in providing flexible, efficient, and dynamic power generating capacity.

As at the end of 2010, Wärtsilä had delivered 4500 power plants to 168 countries, providing a total of over 47 GW of energy capacity.

via Wärtsilä strengthens its presence in Turkey with another major power plant order | Reuters.