By Mark O’Byrne

Gold’s London AM fix this morning was USD 1,627.00, EUR 1,250.77, and GBP 1,008.99 per ounce. Friday’s AM fix was USD 1,629.50, EUR 1,240.20 and GBP 1,007.54 per ounce.

Silver is trading at $29.74/oz., €22.91/oz. and £18.47/oz. Platinum is trading at $1,525.50/oz., palladium at $635.40/oz. and rhodium at $1,350/oz.

Gold fell $3.70 or 0.23% in New York yesterday and closed at $1,638.70/oz. Gold started out sideways in Asia then gradually dropped lower and this weakness continued in early European trading.

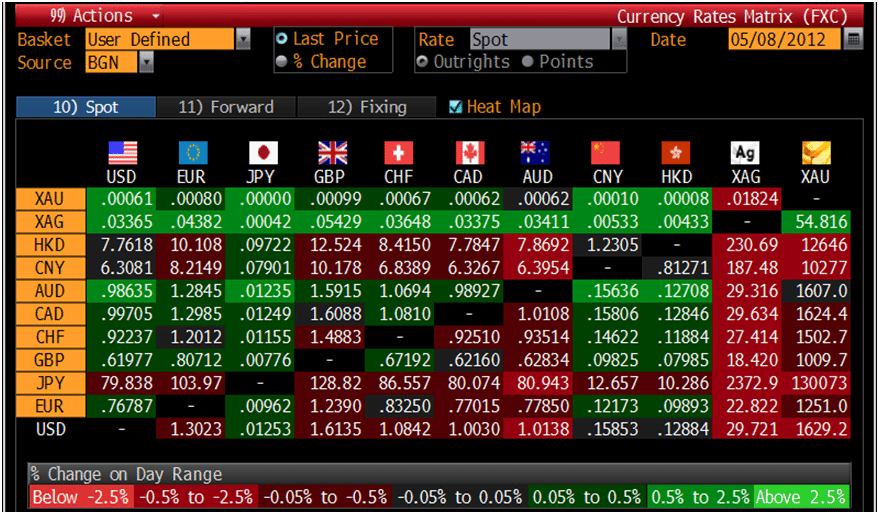

Cross Currency Table – (Bloomberg)

Gold edged lower on Tuesday despite the weaker euro and stock markets after furious citizens in Greece and France voted against austerity measures. Gold prices are being supported by bargain hunters who continue to buy dips around the lower end of the metal’s recent range between $1,620/oz. and $1,680/oz.

The elections in France and Greece create added political uncertainty to an already extremely uncertain financial and political situation and this is likely to weigh on the euro.

Euro gold remains firm around the EUR 1,250/oz. level where it has been consolidating since mid-March – in a range between €1,228/oz. and €1,276/oz.

Gold has been trading between $1,620 and $1,680 for about a month. It is supported by the very uncertain macroeconomic and monetary environment but recent price weakness has made some buyers – especially more speculative buyers in western markets hesitant.

via Turkey Exports ‘Massive Quantities Of Gold’ | Resource Investor.