Turkey-Iran: gold for gas US scrutiny

November 28, 2012 4:24 pm by Daniel Dombey

More pressure is coming Turkey’s way over gas purchases from Iran.

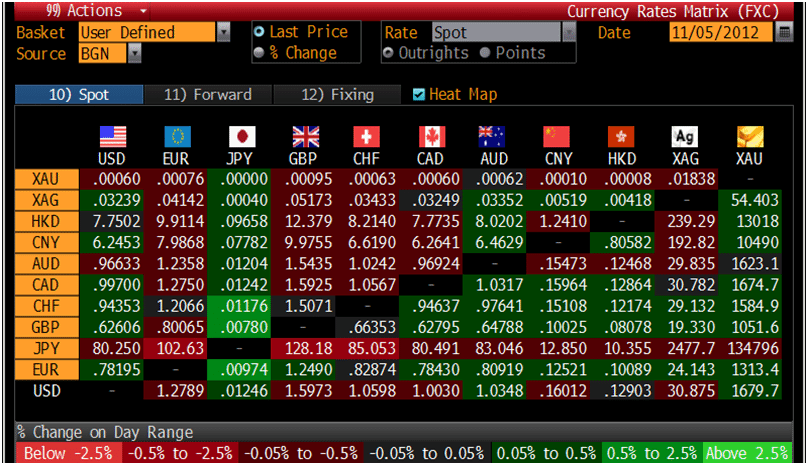

After the Turkish government’s admission last week that Tehran was using revenue from gas sales to Ankara to buy gold and then shipping the metal back home, the gas-gold trade has attracted (almost certainly unwelcome) attention from the US Senate.

Reuters has reported that a group of senators are working on a sanctions package that would, among other things, end Turkey’s “game of gold for natural gas”, according to an aide. The measures could be added to a defence bill before the current US Congress breaks up; if not, the issue is very likely to be on the agenda when its successor convenes in January.

To be clear: at present Turkey’s natural gas purchases from Iran, its second biggest supplier, are not targeted by sanctions, international or unilateral. The EU is implementing gas sanctions, but they are not extra-territorial, instead governing imports by member states. US sanctions threaten action against banks that facilitate oil purchases from Iran, but Turkey currently has a waiver.

What is the case, however, is that the general sanctions push over Iran’s nuclear programme, including blacklisting by Swift, which handles global banking transactions, has rendered traditional financial transfers with Tehran near impossible, even for a neighbouring state such as Turkey. Hence Iran’s recourse to gold.

And, as the US looks for additional leverage over Iran ahead of possible bilateral talks on the nuclear file, Turkey’s gas purchases present an ever bigger target.

It is worth bearing in mind the scale of the trade – Turkey’s purchases in 2010-11 amounted to some $6bn – and its strategic importance to Ankara, which would otherwise depend even more on gas from Russia, its primary supplier.

So the sanctions could further test US-Turkish ties, already testy in the light of Ankara’s recent denunciations of Israel and prime minister Recep Tayyip Erdogan’s largely fruitless campaign for Washington to do more against Syrian President Bashar al-Assad.

But Mark Fitzpatrick, a former US State Department official now at London’s International Institute for Strategic Studies, thinks there is room for finesse.

“The [US] executive branch will be looking to implement the sanctions in a way that gives them some discretion, so they don’t punish Turkey in one fell swoop; they can request significant reductions [in Iranian gas purchases] and ‘significant’ won’t be defined,” he says, comparing such a stand to the demands Washington has always made about Chinese oil purchases from Iran. “It is going to play out in the next two years.”

Nonetheless, he suggests that, as time goes by, pressure is only going to increase on Iranian trading partners such as Turkey: “I have been predicting that the best case outcome for the Iran crisis is a long cold war, where sanctions just keep getting tighter, the Iranians keep the [uranium] enrichment programme going but it never quite reaches the crisis point where it produces nuclear weapons.”

via Turkey-Iran: gold for gas US scrutiny | beyondbrics.