The Big Picture

Turkey considers itself a leader in the broader Muslim world, a part of its identity that has compelled it to speak out against China’s ongoing detention of Turkic Chinese Muslims. The current AKP-led government in Ankara is defending its cultural and religious credentials in upcoming local elections, and defending the Uighurs helps in that regard. But this is also a position that could threaten Turkey’s economic ties to China, which is intent on defending its security crackdowns against Uighurs in the name of national security.

See Turkey’s Resurgence

What Happened

The Turkish Foreign Ministry released a statement Feb. 9, calling on Beijing to respect fundamental human rights and close its internment camps for China’s Uighurs, calling them a “great shame for humanity.” Foreign Ministry spokesman Hami Aksoy added that “it is no longer a secret that more than 1 million Uighur Turks incurring arbitrary arrests are subjected to torture and political brainwashing in internment camps and prisons.” The Chinese Embassy in Ankara responded Feb. 10, calling the Turkish allegations inaccurate and demanding that Turkey retract them.

Why It Matters

Turkey is the first major Muslim country to speak out against the ongoing internment of Chinese Uighurs, who share Turkic roots with most of Turkey’s population. The statement’s timing makes domestic political sense in light of the upcoming March 31 municipal elections in Turkey, in which the ruling Justice and Development Party (AKP) is defending its turf in the Anatolian heartland against other nationalist and Islamist parties. The AKP has come under increasing criticism from other parties, including the nationalist Good Party, over the Turkish government’s silence in the face of fellow Muslims’ suffering.

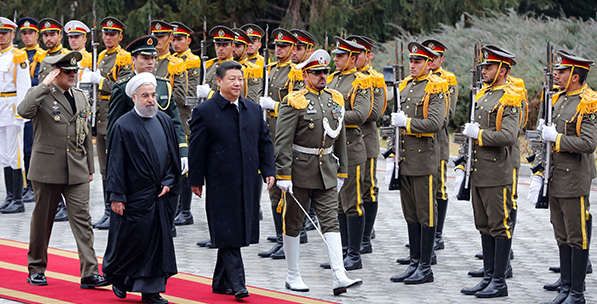

Even though the statement appears measured, it could damage Turkey’s economic ties with China just as the Turkish government has said it wants to increase them. Turkey has explored purchasing Chinese missile systems in the past, President Recep Tayyip Erdogan has invited his Chinese counterpart, Xi Jinping, for a state visit to Turkey in 2019, and the Industrial and Commercial Bank of China recently extended Turkey a multimillion-dollar loan.

The ruling Justice and Development Party (AKP) has come under increasing criticism from other parties over the Turkish government’s silence in the face of fellow Muslims’ suffering.

The Uighur issue is particularly sensitive to China given that the Uighur homeland, China’s westernmost region of Xinjiang, is a vital part of Beijing’s Belt and Road Initiative. It affords the Chinese initiative with direct links to Central Asia and Pakistan that continue onward as far as Europe. Chinese fears of separatism, supply chain disruptions and the risk that Western countries could exploit the issue to China’s disadvantage will, in fact, compel Beijing to consolidate its security hold over Xinjiang. In pursuit of this objective, which has accelerated over the past three years, the Chinese government has engaged in a broad security crackdown in Xinjiang, detaining as many as 1 million ethnic Uighurs, Hui and Kazakhs and subjecting them to re-education.

Background

As part of its political identity under the AKP, Turkey has championed popular Islamism and political Islam. And, even if it were to face Chinese economic retaliation for its outspokenness on the Uighurs, Turkey isn’t as vulnerable as other leading Muslim states. The Arab Gulf states have deeper economic ties with China, while Iran needs its relationship with China — especially as Western sanctions pressure builds up on it. Each has received some heat regarding its relative silence on the issue, increasing the significance of the Turkish statement.

In the broader Muslim world, Indonesia is another country to watch. With national elections approaching April 17, the campaign of candidate Prabowo Subianto has criticized incumbent President Joko “Jokowi” Widodo for neglecting the Uighur issue, alleging that he is beholden to China. But while Jokowi’s foreign minister has reportedly expressed concerns to China in private about the Uighur crackdown, the president is focused on pursuing billions of dollars in Chinese support to remedy Indonesia’s deep infrastructure deficits. At the same time, he is likely trying to avoid inflaming sentiment against his country’s ethnic Chinese minority.