By Chris Summers BBC News

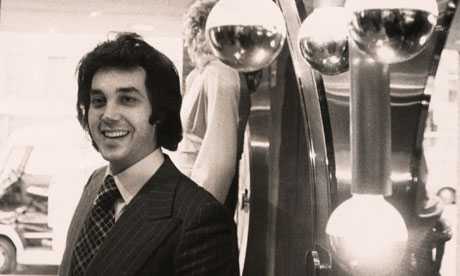

Asil Nadir with his second wife, Nur, who was still a child when he fled the UK in 1993

Asil Nadir with his second wife, Nur, who was still a child when he fled the UK in 1993Related Stories

- Asil Nadir jailed for 10 years

- How Asil Nadir charmed the City

- How Asil Nadir stole millions

Former tycoon Asil Nadir has been jailed for 10 years after being convicted by a British court of stealing millions of pounds from his Polly Peck business empire.

Nadir got his big break in business after the Turkish invasion of Cyprus.

“He is a symbol in Cyprus,” says veteran Greek Cypriot politician Alexis Galanos, “for the taking of land and property that did not belong to him and was given to him by [the late Turkish Cypriot political leader, Rauf] Denktash.”

In the 1980s and early 90s Asil Nadir was the darling of the City of London as the share price of his Polly Peck International (PPI) empire went up and up.

The business collapsed in October 1990, and three years later he fled to northern Cyprus.

But it has since emerged his big break may have come as a direct result of the Turkish invasion of Cyprus in 1974.

Nadir was born in northern Cyprus in 1941, the son of a modest Turkish Cypriot businessman, and grew up in the Agios Loukas district of Famagusta.

He had several Greek Cypriot friends at school and never promoted nationalist views.

People who knew him say politics always played second fiddle to money.

In 1963 he moved to London and set himself up in business as ethnic tensions were emerging in his homeland.

Famagusta, where Asil Nadir grew up, is now largely deserted as Cyprus reunification talks grind on

Famagusta, where Asil Nadir grew up, is now largely deserted as Cyprus reunification talks grind onNadir looked on from afar as Turkey invaded in 1974, following a coup by Greek nationalists in Nicosia.

Nadir gave his own take on the invasion to the jury at his recent trial: “There was a problem with the two communities and there were three signatories to the Cyprus [1960 independence] treaty – Greece, Turkey and Britain – to make sure they did not annihilate each other.

“[In 1974] Britain and Greece declined and Turkey, after consultation with Britain, went in there and intervened.”

When the dust settled the Turks found themselves in possession of property, factories and orchards abandoned by their fleeing Greek Cypriot owners.

‘Many unknowns’

Giving evidence, Nadir said: “After the war the island was split into two. There was a population exchange. All the Turks in the south went to the north and the Greeks in the north went to the south.”

In the 1980s, the economy of the north, hit by a trade embargo, was in dire straits and Rauf Denktash sought out entrepreneurs within his community.

Nadir volunteered, with one eye on the profit margin.

Nadir later fell out with Turkish Cypriot leader Rauf Denktash, who died earlier this year

Nadir later fell out with Turkish Cypriot leader Rauf Denktash, who died earlier this yearHe told the Old Bailey trial he had not done anything improper but added: “Because of the settlement there were a lot of unknowns and a lot of difficulties and a lot of opportunities with properties.

“The government in the north created property points that were given to people who were displaced from their previous areas. Property points were like title deeds and you could acquire the properties [left by the Greek Cypriots].

“There was a legal market in Cyprus which my family was involved in.”

Over the next few years Nadir took over a number of hotels, factories, warehouses and citrus fruit orchards.

These included the Jasmine Court apartment complex in Kyrenia and the Constantia Hotel (since renamed the Palm Beach Hotel) in Famagusta.

The Nadir trial was shown a glossy PPI promotional video, made in 1989, which featured both the Palm Beach and the Jasmine Court.

It was also shown a 1988 contract by which the self-declared Turkish Republic of Northern Cyprus (TRNC) leased out Jasmine Court to PPI’s subsidiary, Voyager Kibris.

Yiannis Varnava, who fled the Constantia at the time of the invasion aged 15, told the BBC: “We left Famagusta several days before the Turks came but it has been a working hotel ever since.”

Famagusta, which was an overwhelmingly Greek Cypriot town, is now part of the TRNC but it has a strong Greek Cypriot exile community and even a football team, Anorthosis, who play in exile in Larnaca.

Mr Galanos, elected mayor-in-exile of Famagusta in 2006, says: “What happened in Cyprus cannot be remedied easily. It makes it very difficult to unify the island. Most of the Greek Cypriot owners are still trying to get compensation.”

Citrus centre

Along with large areas of fruit orchards, Nadir was also handed a fruit-and-vegetable packaging plant at Kato Zodia, near Morphou, which had belonged to a Greek Cypriot fruit growers’ co-operative, Sedigep.

This originally Greek Cypriot-owned fruit packing plant in northern Cyprus was taken over by Asil Nadir

This originally Greek Cypriot-owned fruit packing plant in northern Cyprus was taken over by Asil NadirPanicos Champas, general secretary of the Union of Cypriot Farmers, told the BBC: “From an early age I used to help my parents with the farm we had in Kato Zodia.

“Now, 200 metres from our house is the packaging factory where, we learned, Asil Nadir illegally traded our products, utilising the factory owned by us producers.”

Mr Champas said, in his opinion: “Asil Nadir is an illegal merchant who has been exploiting our properties for many years and gaining money at our expense.”

Nadir referred in court to Morphou by its Turkish name, Guzelyurt, and said that 80% of citrus grown on the island grew in this area.

PPI, he said, owned thousands of citrus plantations in the Morphou area.

In 1980 he took over PPI, and its early success was built on fruit juice.

PPI’s main subsidiaries were Uni-Pac Packaging and Sunzest Trading.

‘For virtually nothing’

Many people in the Greek Cypriot community, both on the island and in the UK, believe the leg-up Nadir was given by Mr Denktash played a considerable part in his rise.

Kyrenia – known to the Turks as Girne – is now a prime holiday destination

Kyrenia – known to the Turks as Girne – is now a prime holiday destinationCostas Apostolides, an economist and journalist with the Cyprus Mail, was the first to write about Nadir’s property deals in the 1980s.

He told the BBC: “He received various properties for virtually nothing. Initially it was citrus-growing areas and later hotels and a large complex of flats in Kyrenia.”

Mr Apostolides said Nadir had been given large tracts of land at Alacati (Alagadi) and Voukalida (Bafra), both of which had beautiful beaches and “fantastic potential” for tourist development.

By the late 1980s, he was the doyen of entrepreneurs and was raising millions from shareholders.

But Mr Apostolides said: “This land belonged to displaced people. They have not cost [the Turks] anything and you are then giving them to somebody else to exploit.”

Nadir’s trial at the Old Bailey heard allegations the 71-year-old had stolen more than £100m from PPI between 1987 and 1990 and fed it back to banks in the TRNC.

Mr Denktash, his political ally, sheltered him after he jumped bail in 1993 and fled back to the island, but publicly broke with him the following year.

Mr Denktash called for his arrest on charges of tax evasion but no action was taken.

As a citizen of the TRNC, a state only recognised by Turkey, he could not be extradited to the UK.

Asil Nadir told the trial he had become involved in the “legal market” for property in northern Cyprus

Asil Nadir told the trial he had become involved in the “legal market” for property in northern CyprusEleni Meleagrou, a lawyer specialising in reclaiming Greek Cypriot property in the north, said she herself had discovered that an area of orange groves which belonged to her father had ended up in Nadir’s hands.

Ms Meleagrou, the former wife of writer Christopher Hitchens, said: “A plot in Kapouti, near Morphou, had been leased by the TRNC to Asil Nadir to use as a plant producing orange juice from the orange groves in the area.”

She is one of a number of Greek Cypriots who have applied to the Immovable Property Commission, a body set up by the TRNC to assess claims to ownership of land in northern Cyprus.

The Turkish Cypriot authorities said recently the Immovable Property Commission had paid out £60m in compensation to Greek Cypriot land-owners.

Nadir stayed a fugitive in northern Cyprus, occasionally venturing over to Turkey, until 2010 when he decided to return to the UK to face the music.

But in 1998, eight years after PPI collapsed, four companies – the Marangos Hotel Company, Pharos Estates, Sedigep and Cyprus Ports Authority – took legal action against PPI’s administrators.

The judgement in the Court of Appeal ruled the English courts had no jurisdiction to hear the claim.

Nadir’s trial at the Old Bailey heard administrators had been unable to track down money in northern Cyprus.

Philip Shears QC, prosecuting, said documents about the deposits said to have been made by his mother Safiye were fake.

Nicosia in Cyprus – Lefkosa in Turkish – is the world’s last divided capital city

Nicosia in Cyprus – Lefkosa in Turkish – is the world’s last divided capital cityAccountants who went to northern Cyprus were unable to speak to Mrs Nadir and had difficulty with the tycoon’s employees.

“Administrators were met with obstruction, and inaccurate and inconsistent accounts and explanations,” said Mr Shears.

Nadir has so far not replied to a series of questions from the BBC about his business dealings in Cyprus.

He denied 13 sample counts of theft but was convicted of 10 after a seven-month trial and was jailed for 10 years on Thursday.

Mr Apostolides says: “This was not just considered appalling by Greek Cypriots but also it was unfair to Turkish Cypriots because this was someone coming from outside who was given the chance to exploit the whole country.”