Emil Sanamyan’s articles on Armenian-Americans, Armenia and its neighborhood.

Saturday, October 11, 2008

Sen. Byrd and Rep. Wexler on Turkey and Iraq war

First published in September 13, 2008 Armenian Reporter.

Turkey’s friends on the Hill: U.S. was wrong, Turkey right on Iraq

In recent books, two Democrats offer whitewash of Turkey’s position

review by Emil Sanamyan

WASHINGTON – Senator Robert Byrd (D.-W.V.), a veteran politician referred to in the past as the “senator from Istanbul,” and Rep. Robert Wexler (D.-Fla.), a young member of Congress who just may be popular enough in Turkey to one day become its prime minister, published their books over the summer.

Timed for release in a presidential election year, both books focus on criticisms of the Bush administration and particularly its decision to invade and occupy Iraq. In the process Mr. Byrd and Mr. Wexler also share their admiration for Turkey, highlighting in particular its opposition to the Iraq war – without listing, however, many of the reasons for that opposition.

Both authors also avoid any mention of their efforts, on behalf of Turkish government, to kill resolutions affirming the U.S. record on the Armenian Genocide.

Commenting on that subject during a July 14 book presentation organized by the Turkish lobby in Washington (see the Washington Briefing in the July 19 Armenian Reporter), Mr. Wexler noted that he represents a Florida district with probably the largest number of Holocaust survivors nationwide.

“Issues relating to genocide of any type, alleged or not, have great sensitivity,” Mr. Wexler admitted, adding that one of his opponents this year is a son of a Holocaust survivor and used Mr. Wexler’s position on the Armenian Genocide resolution against him.

Although West Virginia may have the smallest number of Holocaust survivors nationwide and there is hardly another member of Congress with a safer seat, Mr. Byrd also decided not to parade his record as an opponent of Genocide affirmation.

The “Senator from Istanbul”

Mr. Byrd is the longest-serving member of Congress; next year he will mark 50 years in elected office.

As the Bush administration readied for the 2003 invasion, Mr. Byrd made an impassioned speech in the Senate arguing that the administration was going to war without a clear mandate from Congress and without Congress clearly informed as to threats Iraq posed to U.S. interests.

In his book titled Letter to a New President: Commonsense Lessons for Our Next Leader (Thomas Dunne Books, 2008), Mr. Byrd also suggested that the “Bush Administration made the mistake of taking Turkish cooperation in the [Iraq war] for granted.”

He writes: “The bitter and intemperate U.S. reaction to [the Turkish parliament’s decision not to allow the United States to open a northern front,] put more strain on U.S.-Turkey relations, as did U.S. backing of Iraqi Kurds in Kurdistan.”

As a result, Mr. Byrd writes, the United States was left with “a foreign policy disaster,” whereas Turkish public’s approval for the United States fell from 52 percent in 1999 to 9 percent in 2007.

In the book, Mr. Byrd also recalls the start of his relationship with Turkey in the early days of the Cold War. Shortly after his election to the House of Representatives and appointment to its Foreign Affairs Committee, the 38-year-old Rep. Byrd made his first-ever trip abroad with a delegation led by committee chair Rep. Clement Zablocki (D.-Wis.)

The 1955 trip included a number of Western European countries and Turkey, which impressed the young member of Congress as a “key U.S. ally . . . with a largest standing army in Europe.”

Turkey’s would-be prime minister

“My wife jokes I could run for Prime Minister of Turkey,” Rep. Wexler writes in his Fire-breathing Liberal: How I Learned to Survive (and Thrive) in the Contact Sport of Congress (Thomas Dunne Books, 2008).

The representative is proud of his popularity in Turkey and that, having been to the country seven times, he gets the same level of access in Ankara as does Secretary of State Condoleezza Rice.

In Congress since 1996, Mr. Wexler “as co-founder of the Turkey caucus, worked hard to improve relations between the United States and that democratic, secular Muslim nation, a critical ally in the fight against terrorism.”

As Mr. Byrd, Mr. Wexler writes that Turkey was right and the United States wrong on Iraq. “Had Bush listened to the advice of experts in the Turkish Foreign Ministry before launching the Iraq war, it is quite possible we wouldn’t be facing the chaos we’ve created now,” he writes.

The representative recalled that shortly before the U.S. invasion, he met the Turkish Foreign Ministry’s undersecretary Ugur Ziyal, who “smoked many cigarettes with the most knowledgeable and powerful diplomats in the region.”

Mr. Ziyal told Mr. Wexler that as bad as Saddam Hussein was, he was successfully containing various conflicting groups within Iraq and that without Hussein “chaos would replace despotism.”

But instead of listening to these arguments, the United States’ message to Turkey, as delivered by then-Deputy Defense Secretary Paul Wolfowitz was “either you are with us or against us.”

Mr. Wexler writes, “you will never successfully persuade a Turkish political entity, whether it’s individual or the Turkish Parliament, by first demeaning them.”

He added: “Even if your logic is correct, and they should take certain steps, if you belittle them, they are not going to give you what you want.”

Why Turkey opposed the war in Iraq

While discussing U.S.-Turkish differences over Iraq, both authors leave the impression that Turkey’s opposition to the U.S. invasion was either born out of Ankara’s penchant for nonviolence or based on some deep knowledge of regional realities rather than selfish calculations.

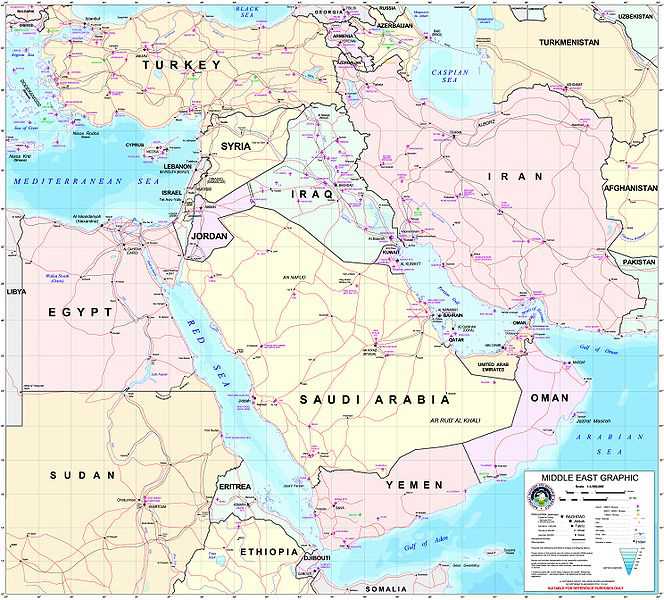

In fact, for more than 30 years Turkey has occupied northern Cyprus and repeatedly invaded northern Iraq both before and after the 2003 war. Maintaining one of the largest militaries in the world, Turkey remains a big believer in hard power.

At the same time, it is no secret that Saddam Hussein’s rule over Iraq – and particularly his persecution of Kurds – was seen as beneficial to Turkey’s own security interests, focused as they have been since World War I on the Kurdish rebellion within Turkey that has gone on, with some significant interruptions, for more than 80 years.

As both U.S. and Turkish sources make clear, Turkey’s eventual decision to stay out of the 2003 invasion of Iraq was more likely a product of an exaggerated sense of self-importance which led Ankara to demand a steep price for its cooperation.

In the Turkish Milliyet newspaper, Fikret Bila wrote on December 5, 2002: “The USA has demanded military support from Turkey [in Iraq]. Turkey has put forth four conditions that must be fulfilled if Turkey is to meet the American demands. Here are Turkey’s conditions:

“1. The war would entail, for Turkey, an estimated cost of $20-25 billion. America should meet that cost. Furthermore, that money must come directly from the USA’s War Budget.

“2. Establishment of a Kurdish state in the North must not be permitted. If a federation is to be established in Iraq, Turcomans must be given the same status as the Kurds.

“3. In the operation to be staged against Saddam, the Peshmergas [Kurdish militia groups in Northern Iraq] must not be used so as not to compromise the security of the Turcomans and Arabs in the region. The Peshmergas must not be armed.

“4. If the war is going to be waged from the North, the region’s coming under British control would be unacceptable to Turkey. Security and control in Northern Iraq must be a job for Turkey.”

Writing in his book Cobra II: The Inside Story of the Invasion and Occupation of Iraq (Pantheon, 2006), Michael Gordon recalls that months before the war “Turks… demanded $25 billion in outright grants from Colin Powell at an 11 PM meeting at the home of the Secretary of State.”

The United States could not afford that price tag for Turkish cooperation and instead scraped up a package that included “$3 billion in aid, $3 billion in financing, and a promise to make a concentrated effort to persuade Persian Gulf states to provide $1 billion in free oil to help Turkish companies secure reconstruction contracts in Iraq and Afghanistan.”

But this $10 billion package was not deemed as sufficient baksheesh. The Turkish government and military did not lobby their national parliament to approve U.S. use of Turkish territory for the invasion, and the proposal failed by just a few votes.

Days later, the United States invaded without the Turkish front.