By TIM MAK

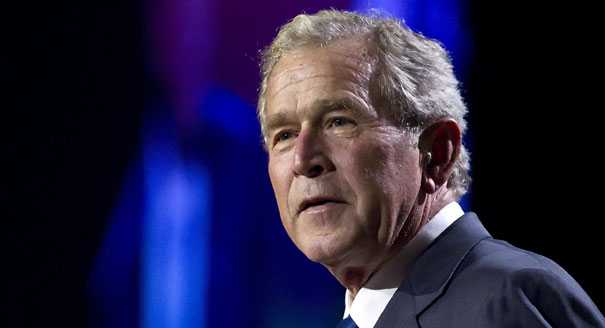

The human rights group Amnesty International called on Canadian authorities Wednesday to arrest former President George W. Bush when he attends an economic summit in the province of British Columbia next week.

The group accused Bush of “responsibility for crimes under international law including torture.”

Amnesty International asked that Canada either prosecute or extradite Bush for violations that they allege took place during the CIA’s secret detention program between 2002 and 2009. The organization wrote a 1,000 page memorandum addressed to Canadian authorities to make the case for human rights violations by the 43rd president.

“Canada is required by its international obligations to arrest and prosecute former President Bush given his responsibility for crimes under international law including torture,” Susan Lee, Americas Director at Amnesty International, said in a statement.

The Canadian government responded to the request with critical words for Amnesty International.

“I cannot comment on individual cases… that said, Amnesty International cherry picks cases to publicize based on ideology. This kind of stunt helps explain why so many respected human rights advocates have abandoned Amnesty International,” Canadian Minister of Citizenship and Immigration Jason Kenney told POLITICO, noting that Amnesty International had never sought a court order to bar Cuban dictator Fidel Castro or Tongolese dicator Gnassingbé Eyadema from Canada.

“Perhaps this helps to explain why Salman Rushie has said that ‘it looks very much as if Amnesty’s leadership is suffering from a kind of moral bankruptcy,’ and why Christopher Hitchens has written about the organization’s ‘degeneration and politicization,’” Kenney added.

Bush cancelled a visit to Switzerland in February after facing similar public calls for his arrest by the other human rights groups.

Amnesty International said that Canada was obligated to arrest Bush under its commitments to the UN Convention Against Torture. The human rights organization objected to the Bush administration’s “enhanced interrogation techniques” and violations they characterized as “cruel, inhuman and degrating treatment and enforced disappearances.”

“A failure by Canada to take action during his visit would violate the UN Convention against Torture and demonstrate contempt for fundamental human rights,” said Lee.

www.politico.com, 12.10.2011