The Archbishop of Canterbury has said this year’s riots and financial crisis have led to “broken bonds and abused trust” in Britain.

The Archbishop of Canterbury has said this year’s riots and financial crisis have led to “broken bonds and abused trust” in Britain.

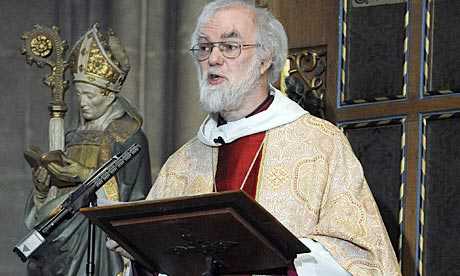

In his Christmas Day sermon, Dr Rowan Williams said: “The most pressing question we now face… is who and where we are as a society.”

Riots in August were sparked by the shooting of Mark Duggan by police.

The head of the Catholic Church in England and Wales, Vincent Nichols, has offered prayers for Palestinians.

During his Christmas Mass sermon at Westminster Cathedral, Archbishop Nichols focused on 50 Palestinian families in the West Bank who he said faced losing their land to Israel.

He said: “At this moment the people of the parish of Beit Jala in Bethlehem prepare for their legal battle to protect their homes and their land from further expropriation from Israel… we pray for them tonight.”

In his sermon at Canterbury Cathedral the Archbishop said: “Bonds have been broken, trust abused and lost.

“Whether it is an urban rioter, mindlessly burning down a small shop that serves his community, or a speculator turning his back on the question of who bears the ultimate cost for his acquisitive adventures in the virtual reality of today’s financial world, the picture is of atoms spinning apart in the dark.”

Since October, the Church of England has had to handle the anti-capitalist encampment near St Paul’s Cathedral.

The Canon Chancellor of St Paul’s, Dr Giles Fraser, initially supported the Occupy London protest but later resigned amid suggestions of a rift between senior clergy.

The Book of Common Prayer celebrates its 350th anniversary next year and Reverend Williams quoted from it in his sermon.

“If ye shall perceive your offences to be such as are not only against God but also against your neighbours; then ye shall reconcile yourselves unto them; being ready to make restitution,” he said.

‘Mysteries of faith’

The Archbishop said the language of the Prayer Book may sound dated but he said: “Before we draw the easy and cynical conclusion that the Prayer Book is about social control by the ruling classes, we need to ponder the uncompromising way in which those same ruling classes are reminded of what their power is for, from the monarch downwards.

“And the almost forgotten words of the Long Exhortation in the Communion Service, telling people what questions they should ask themselves before coming to the Sacrament, show a keen critical awareness of the new economic order that, in the mid 16th century, was piling up assets of land and property in the hands of a smaller and smaller elite.”

The Archbishop said: “The Prayer Book is a treasury of words and phrases that are still for countless English-speaking people the nearest you can come to an adequate language for the mysteries of faith.”

The Archbishop also urged people not build lives based on selfishness and fear.

The reference to the riots is not the first time Dr Williams has addressed the subject.

Last month, he wrote in The Guardian about the “enormous sadness” he felt during the riots.

But in the same article he said the government should do more to rescue young people “who think they have nothing to lose”.

Dr Williams also said recently he was sympathetic to a “Robin Hood” tax on some financial transactions.

BBC