Antony P. Mueller writes: In September 2010, a short time before the international financial summit of the Group of Twenty (G20) took place in South Korea, Brazilian finance minister Guido Mantega declared that the world is experiencing a “currency war” where “devaluing currencies artificially is a global strategy.”

By announcing the outbreak of a “currency war,” Mantega wanted to draw attention to the problems caused by the ongoing exchange-rate manipulations that governments put in place in order to gain economic advantages. In this sense, “currency war” denotes the conflict among nations that arises from the deliberate manipulation of the exchange rate in order to gain international competitiveness by way of currency devaluation.

By announcing the outbreak of a “currency war,” Mantega wanted to draw attention to the problems caused by the ongoing exchange-rate manipulations that governments put in place in order to gain economic advantages. In this sense, “currency war” denotes the conflict among nations that arises from the deliberate manipulation of the exchange rate in order to gain international competitiveness by way of currency devaluation.

Competitive Devaluation

Calling competitive devaluation a “war” may seem like a gross exaggeration. Yet in terms of its potential of destruction, the current global financial conflict may well rank at a level similar to that of a real war.

In a wider historical perspective, the current currency war is the latest conflict in a series of acute crises of the modern international monetary system. In a world of national monetary regimes based on fiat money without physical anchors, domestic monetary instability automatically transforms into exchange-rate instability. As before, the current crisis of the international economic order is mainly the result of monetary fragilities coming from the unsound national monetary systems and reckless domestic monetary and fiscal policies.

The immediate cause of the currency war entering an acute stage is the policy of massive quantitative easing practiced by the US central bank. Whatever the original intention of this policy may have been, the consequences of the Fed’s measures include monetary expansion, low interest rates, and a weaker US dollar. With dollar interest rates approaching the “zero bound,” the United States is joining Japan in the effort to stimulate a sluggish economy with massive monetary impulses.

Until recently, the currency war was contained as a kind of financial cold war. The conflict entered its hot phase as a result of the expansive monetary policies that were put in place in the wake of the financial-market crisis that began in 2007. In defiance of the fact that the financial crisis itself was the result of the extremely expansive monetary policies in the years before, many central banks have now accelerated monetary expansion in the vain attempt to cure the disease with the same measures that had caused it in the first place.

Easy Money and International Financial Flows

What has emerged in the global financial arena over the past couple of years is the interplay among easy money, low interest rates, international trade imbalances, financial flows, and exchange-rate manipulations. The failure of attempts to cure overindebtedness with more debt, and to stimulate weak economies by giving them interest rates as low as possible, provokes a repetitive pattern of bubble and crash where each phase ends in a higher level of government debt.

A global search for higher yields has been going on not unlike what happened in the late 1960s and 1970s, when the United States inflated and the countries that had linked their exchange rates to the US dollar suffered from imported inflation. Nowadays, the formal dollar-based fixed-exchange-rate system no longer exists. It has been replaced by a system that sometimes is called “Bretton Woods II”: a series of countries, particularly in Asia this time, have pegged their exchange rates (albeit without a formal agreement) to the US dollar.

If a country wants to slow down the appreciation of its exchange rate that comes as a consequence of the financial inflows from abroad, it must intervene in the foreign-exchange markets and monetize at least a part of the foreign exchange. This way, the monetary authorities will automatically increase the domestic money stock. Additionally, under this system relatively poor countries feel forced not only to buy the debt issued by the relatively wealthy countries like the United States but also to buy these bonds at their current extremely low yields.

Under current conditions, the monetary expansion gets globalized and invades even those countries that wish to practice restrictive monetary policy. Relatively high levels of the interest rate improve the restrictive currency’s attractiveness. Thus, more and more monetary expansion happens on a global scale, which in turn provides the fuel for the next great wave of international financial flows.

The weaker countries, which compete with each other on the basis of low prices, are getting pushed to the side; it was just a matter of time until more and more governments would begin to intervene in the foreign-exchange markets by buying up foreign currencies in order to try to prevent their exchange rates from appreciating too much, too fast.

Yet using the exchange rate as a tool in order to gain economic advantage or avert damage for the domestic economy is inherently at variance with a sound global monetary order, because one country’s devaluation automatically implies the revaluation of another country’s currency and thus the advantage that one tries to obtain will be achieved by putting a burden on other countries.

Escalation

By recycling the monetary equivalent of the trade surplus into the financial markets around the globe, monetary authorities in surplus countries form a symbiosis with trade-deficit countries in fabricating a worldwide monetary expansion of extreme proportions.

“Once again, the international monetary system is on the brink of a breakdown.”

The paradoxical, or rather perverse, features of the current state of affairs were highlighted a short time ago when in January 2011 the monetary authorities of Turkey decided to lower the policy interest rates so as to make the inflow of foreign funds less attractive, despite a booming Turkish economy that shows plenty characteristics of a bubble.

Exchange-rate policies produce the usual spiral of interventionism: the de facto consequences tend to diverge from the original intentions, prompting further rounds of doomed interventions. This interventionist escalation is not only limited to an incessant repetition of the same failed policies, but the errors committed in one policy area also affect other parts of the economy. Thus, it is only a matter of time until errors of monetary policy lead to fiscal fiascos, and exchange-rate interventions lead to trade conflicts.

At first sight, exchange-rate intervention may appear tolerable as the legitimate pursuit of national self-interest. But exchange-rate policies are intrinsically matters that tend to stir transnational controversies. When a country’s exchange rate policy collides with the interests of the trading partners, the tit-for-tat of mutual retaliation automatically tends to lead to an escalation of the conflict. Once the process of competitive devaluation has started, a devaluation by one country invites other countries to devaluate their exchange rates as well. As a consequence, the international monetary order will eventually disintegrate, and sooner or later the conflict will go beyond currency issues and affect a wide spectrum of economic and political relations.

Therefore, because of the unsound monetary system, a peaceful international political system also is constantly at risk. Monetary conflicts provoke political confrontations. Besides the immediate costs of exchange-rate conflicts that come from the damage to international trade and investment, and thereby to the international division of labor, harm will also be done to confidence and trust in the international political arena.

The dispute about exchange rates is the consequence of contradictory tensions that are innate to the modern monetary system. In this respect the currency war is an expression of the defects that characterize an unsound and destructive financial system. The outbreak of the currency war is a symptom of a deeply flawed international monetary order.

Brazil

When Brazil’s finance minister repeated his warnings in January 2011 and said that “the currency war is turning into a trade war,” Mantega sent a signal to the world that the escalation of the trade war had started. Because of the massive inflow of money from abroad, the Brazilian currency had sharply appreciated and the Brazilian economy was losing competitiveness.

In order to reduce the impact on is domestic economy, Brazil had been intervening in the foreign-exchange markets, diminishing the degree of currency appreciation. In doing so, the monetary authorities had to buy foreign currencies, mainly US dollars, in exchange for its domestic money.

By pursuing such a policy over the past couple of years, Brazil has increased its foreign-exchange reserves from around 50 billion to 300 billion US dollars.[1] Yet even despite these foreign-exchange interventions, the Brazilian currency appreciated drastically against the US dollar and other currencies.

By various estimates, Brazilian foreign trade suffers from an exchange-rate overvaluation of around 40 percent. As a consequence, Brazil’s current account balance, which was still at surplus in 2007, has plunged into a deficit of 47.5 billion US dollars in 2010.[2] At the same time when an artificial boom is taking place as the result of massive monetary expansion, the Brazilian economy suffers from creeping deindustrialization.[3]

Part of the explosion of Brazil’s current-account deficit can be explained by weak demand from its trading partners, which have plunged into a prolonged recession. Yet beyond this circumstance, there has been another causal chain at work: the inflow of funds from abroad that boosts the exchange rate provides the grounds for an exorbitant increase of the country’s monetary base.[4]

The combination of ample liquidity at home, weak demand from some trading partners abroad, and a strong exchange-rate appreciation provides the basis for an extreme import expansion that vastly exceeds exports. Unlike a country such as Germany, for example, whose industry is pretty resilient against currency appreciation, Brazil resembles in this respect the countries of the Southern periphery of the eurozone in its incapacity to cope effectively with an overvalued currency.

When, in January 2011, a new government took power in Brazil, the newly-elected president, Dilma Rousseff, declaredin her inauguration speech that she will protect Brazil “from unfair competition and from the indiscriminate flow of speculative capital.” Guido Mantega, the former and new Brazilian finance minister, did not hesitate to join in when he asserted that the government has an “infinite” number of interventionist tools at its disposal with which to protect national interests. Mantega said that the government is ready to use taxation and trade measures in order to stop the deterioration of Brazil’s trade balance.

China

The countries that form the favored group that gets targeted by international financial flows in search of higher yields compete among themselves in order to prevent their currencies from appreciating too much, and as a group these countries compete against China in their efforts to maintain a competitive exchange rate.

China’s position forms part of a long causal chain, which includes low interest rates and monetary expansion in the United States, that fuels higher import demand. Given that China drastically devalued its exchange rate as early as in the 1980s, this country was at the forefront of gaining advantage of America’s import surge; China grabbed the golden opportunity to turn itself into the major exporter to the United States.

In order to maintain its currency at its undervalued level, the Chinese monetary authorities must buy up the excess of foreign exchange that accumulates from its trade surplus, preferably by buying US treasury notes and bonds. In this way, China became America’s main creditor. Over the past decade, China increased its foreign exchange position from a meager $165 billion in 2000 to an amount that was approaching $3 trillion at the end of 2010.

From the 1980s up to the early 1990s, China devalued its currency from less than 2 yuan to the US dollar to an exchange rate of 9 yuan against the US dollar. And despite its huge trade surpluses, China has only slightly revalued the yuan ever since, establishing the current exchange rate at 6.56 yuan per US dollar.

Over the past decade, China has become the major financier of the US budget deficit. Together with other monies flowing in from abroad, the US government was relieved from the need to cut spending. The inflow of foreign capital also allowed the US government to pay lower interest rates for its debt than it would have if only domestic supply of savings were available. Foreign imports put pressure on the price level, and the US central bank could continue monetary expansion without an immediate effect on the price-inflation rate.

If China wants to hold its competitive position through an undervalued currency, the Chinese monetary authorities must continue their policy of intervention in the foreign-exchange markets. As a consequence of buying dollars from its exporters, the domestic money supply in China continues to rise, throwing additional fuel on a domestic boom that is already in full swing.

Even more so than their Brazilian counterparts, China’s political-decision makers have failed to exert moderation or restraint when it comes to interventionist measures. As long as China’s leadership presumes that it gains from exchange-rate manipulation, its currency interventions will go on.

Global Financial Fragilities

Since the abandonment of the gold standard, the global financial system has been in disarray. All the international monetary arrangements that have been established since then have ended in crisis and finally collapsed. For almost a hundred years now, one interventionist scheme has been established and then soon fallen to pieces.

When the monetary and fiscal decision makers in the United States and Europe discarded all restraints against intervention in the wake of the financial market crisis, socialist and interventionist governments around the globe felt vindicated. They had long been convinced that only through state control could financial stability be obtained. Due to the policies adopted by Western countries in their futile attempt to overcome the financial-market crisis, the leaders of the so-called emerging economies have become even more unscrupulous interventionists.

Political leaders around the globe have shed the little that was left of support for free markets and set the controls for a way back on the road to serfdom.

It is mainly due to ignorance that the modern monetary system gets labeled as a laissez-faire or free market system. In fact not only the basic “commodity” of this scheme, i.e., fiat money, but also its price and quantity are largely determined by political institutions such as central banks.

It is more than absurd when, in the face of crises and conflicts, more government intervention gets called upon: it was state intervention in the first place that laid the groundwork for the trouble to appear.

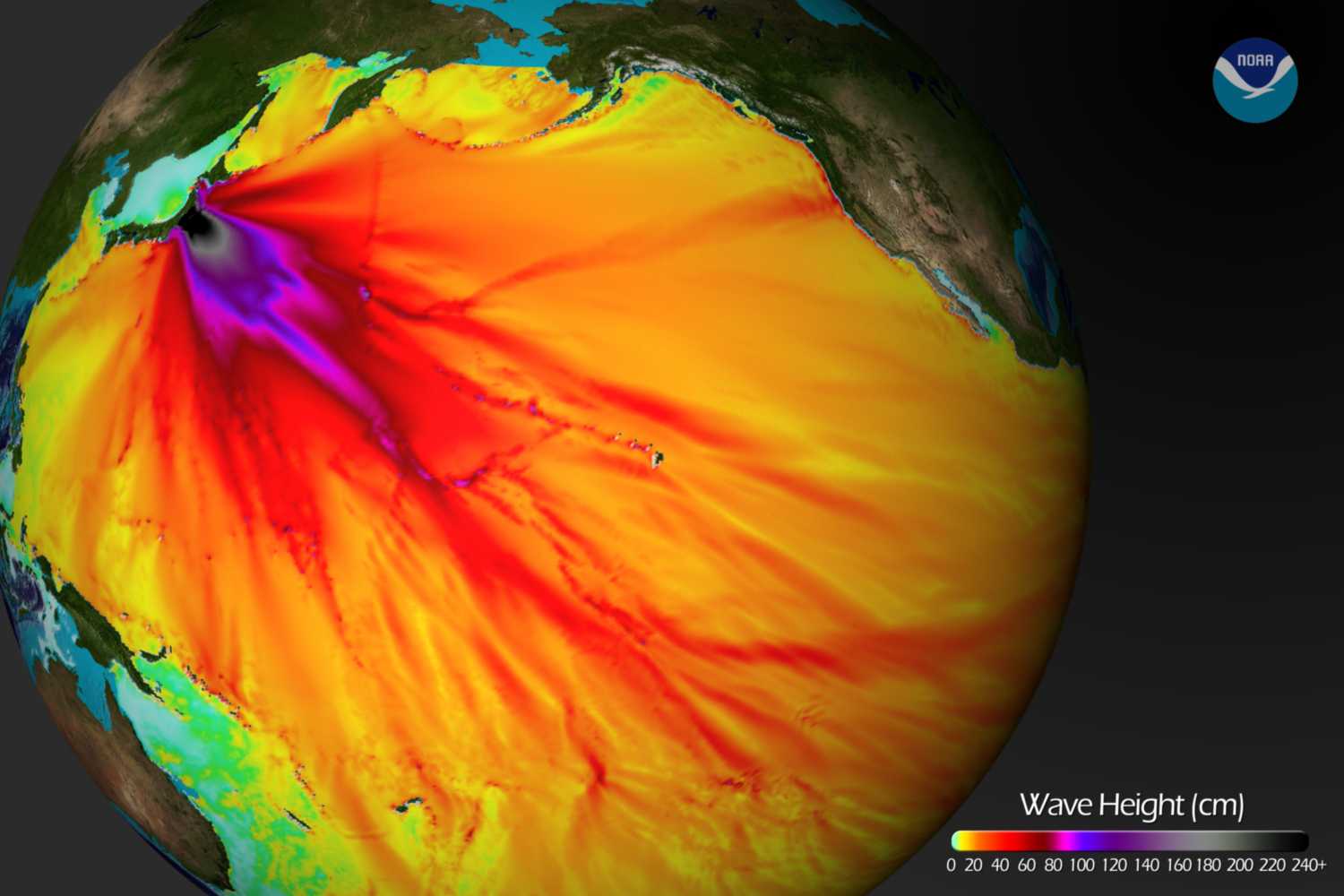

So-called “speculative” international capital flows already happened decades ago. What has changed since then is the amount of hot money and the speed with which it floats around the world. It would be wrong to describe these financial movements as an expression of free markets. The fact, for instance, that in 2010 daily transactions on the international currency market have reached a volume of four trillion US dollars is the result of unhampered fiat-money expansion and massive state intervention in the foreign-exchange markets.

The increase in the global money supply that has been going on for many years finds its complement in a global asset boom. The inflation of money drives up the price of precious metals, natural resources, and food. Once more, the world experiences a period of fake prosperity not much different from the real-estate bubble, and many other episodes, that led to previous financial crises.

Conclusion

The political endeavors to gain competitive advantages through exchange-rate devaluation sows mistrust among nations; and the ensuing regime uncertainties frustrate the business community. Over time the conflict over exchange rates tends to destroy the global division of labor.

Once again, the international monetary system is on the brink of a breakdown. As in the past, the main reason behind the current conflict is extreme monetary expansion. Unsound monetary systems produce turmoil not just at home but also in the international arena. Excessive monetary expansion, which is the cause of domestic malinvestment, is also the root of economic distortions at a global level.

Without a fundamental change of the monetary system itself, without a return to sound money, the international monetary system will remain in a state of permanent fragility — ever oscillating between the abyss of deflationary depression and the fake escape of hyperinflation. This is the fate of the world when nations implement fiat monetary systems and put them under political authority.

Antony Mueller is a German-born economist who lives in Aracaju in Northeastern Brazil where he teaches at the Federal University of Sergipe (UFS). He is an adjunct scholar of the Mises Institute USA and academic director of theInstituto Ludwig von Mises Brasil. See his website and blog. Send him mail. See Antony P. Mueller’s article archives.

www.marketoracle.co.uk, Feb 23, 2011