March 06, 2010

The Coming of “The Ten”

Ten economies are becoming the new locomotive for the global economy

By Martin Walker Senior Director of A.T. Kearney’s Global Business Policy Council

The economic crisis of 2008-2009 appears to be over, but along the way it has transformed the shape and dynamics of the global economy. This unexpected and dramatic development has not been due to the vigor of the Chinese economy or the BRIC economies as a whole, but the emergence of a major new force in the global economy—the 10 middle-income emergent countries.

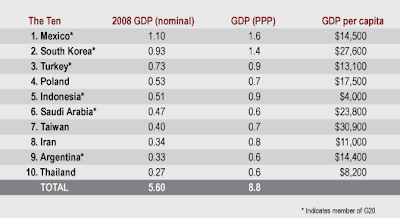

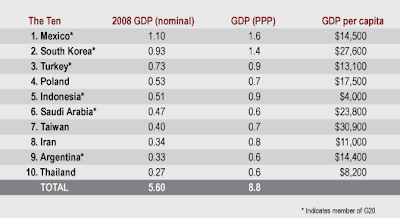

These emergent economies are becoming, with remarkable speed, a whole new motor for the global economy. The 10 biggest of these—Mexico, South Korea, Turkey, Poland, Indonesia, Saudi Arabia, Taiwan, Iran, Argentina and Thailand—had a collective nominal GDP of $5.6 trillion in 2008, according to the IMF, larger than the GDPs of Japan or China. In purchasing power parity (PPP), their collective GDP was $8.8 trillion, larger than the economies of Japan and Germany combined. Indeed, these 10 non-BRIC countries constitute the world’s third largest economic group, after the European Union and the United States.

Considered in this light, the global economy takes on an interesting new shape with five dominant components:

Trade among emergent nations, sometimes called South-South trade, is now the most dynamic component of the global economy. This is NOT simply a factor of the BRIC countries; Brazil, India and Russia accounted for just 5.8 percent of China’s trade. The most striking development is China’s impact on the other emergent markets. Indeed, these other emergent markets helped rescue the Chinese economy from its 2008 nosedive. Taking the year-on-year export figures for November 2009, while Chinese exports to the European Union fell by 8 percent, and its exports to the United States fell by 1.7 percent, China’s exports to the ASEAN nations rose by a dramatic 20.8 percent, and China’s imports rose 45 percent.

Within this decade, current trading trends suggest that South-South trade could overtake trade among the G7 nations, and should also exceed North-South trade. Fueled by rising populations and increased amounts of foreign direct investment, the non-G7 economies are likely to produce more than half of the world’s GDP. (Currently, the G7 economies account for 57 percent of nominal global GDP.)

A Host of New Competitors

Of course, the G7 nations will remain far richer, both as countries and individually, and are likely to continue to enjoy the fruits of their traditional dominance of higher education and technological innovation, among other things. But the large advantage the G7 nations long enjoyed—of comprising the world’s biggest, richest and most attractive consumer market—is being eroded with remarkable and unexpected speed. That means that their consumer tastes and habits will no longer be the global norm. New products are less likely to be developed and launched with Western consumers in mind. Research funds and projects are less likely to be predicated on a Western consumer base. The long tradition of Western cultural dominance, and the political influence and soft power that it generated, is likely to face increasing challenges.

The new world order in the wake of the recession is going to be much less predictable, much more culturally eclectic and even chaotic.

The significance of the growth of “The Ten” as a new locomotive force for the global economy is that there will be no single rival to Western culture, but a host of competitors. Brazilian music, Mexican singers, Turkish literature, Argentine dance, Thai sports, Polish architecture, Saudi calligraphy and Indonesian design will all jostle together in the vast new marketplace, alongside Bollywood movies, Russian space tourism and Chinese manufacturers. The new world order in the wake of the recession is going to be much less predictable, much more culturally eclectic and even chaotic. Some will find it an uncomfortable Babel; others will thrill to the rich excitements of choice and diversity.

Most should be relieved that some gloomy recent suggestions of an inevitable clash of civilizations between China and the West are likely to give way to something more confused. The really good news is that when China’s growth rate slows, as it is likely to do this decade as the labor force peaks and the number of retirees soars, there are now new candidates for future growth ready to take China’s place and maintain global demand.

Martin Walker is senior director of A.T. Kearney’s Global Business Policy Council. He is based in Washington, D.C.

For more information, please contact the author.

The views expressed in this paper are those of the author(s) and do not necessarily represent the views of A.T. Kearney or the Global Business Policy Council. The views are not meant to suggest specific inducement to make a particular investment or follow a particular strategy, but only as an expression of opinion.

==========================================

a summary from mavi boncuk

The coming of Ten

Ten economies are becoming the new locomotive for the global economy By Martin Walker Senior Director of A.T. Kearney’s Global Business Policy Council.

Ten economies are becoming the new locomotive for the global economy By Martin Walker Senior Director of A.T. Kearney’s Global Business Policy Council.

Mavi Boncuk |

The economic crisis of 2008-2009 appears to be over, but along the way it has transformed the shape and dynamics of the global economy. This unexpected and dramatic development has not been due to the vigor of the Chinese economy or the BRIC economies as a whole, but the emergence of a major new force in the global economy—the 10 middle-income emergent countries.

These emergent economies are becoming, with remarkable speed, a whole new motor for the global economy. The 10 biggest of these—Mexico, South Korea, Turkey, Poland, Indonesia, Saudi Arabia, Taiwan, Iran, Argentina and Thailand—had a collective nominal GDP of $5.6 trillion in 2008, according to the IMF, larger than the GDPs of Japan or China. In purchasing power parity (PPP), their collective GDP was $8.8 trillion, larger than the economies of Japan and Germany combined. Indeed, these 10 non-BRIC countries constitute the world’s third largest economic group, after the European Union and the United States.

Considered in this light, the global economy takes on an interesting new shape with five dominant components:

==================================

Martin Walker

Senior Director of the Global Business Policy Council

Martin Walker is the Senior Director of the Global Business Policy Council, a private think-tank for CEOs founded by the A T Kearney business consultancy. He is also a syndicated columnist and Editor-in-Chief Emeritus of United Press International.

Previously, in his 25 years as a journalist with The Guardian newspaper, he served as bureau chief in Moscow and the United States, as well as European editor and assistant editor.

A regular broadcaster on the BBC, National Public Radio and CNN, and panelist on Inside Washington and The McLaughlin Show, he is also a senior scholar at the Woodrow Wilson International Center for Scholars in Washington DC, a senior fellow of the World Policy Institute at the New School for Social Research in New York, and a contributing editor of the Los Angeles Times’s Opinion section and of Europe magazine.

His books include “Waking Giant: Gorbachev and Perestroika,” “The Cold War: A History,” “Clinton: The President They Deserve” and “America Reborn,” published in May 2000 by Knopf. His latest novel “Bruno, Chief of Police” will be published in the U.S. in 2009 by Knopf and in Germany by Diogenes.

==============================================================

Martin Walker Appointed Head of Global Business Policy Council

Renowned Author and Commentator Martin Walker Appointed Head of A.T. Kearney’s Global Business Policy Council

WASHINGTON, D.C. (January 25, 2007)—Global management consulting firm A.T. Kearney today announced the appointment of Martin Walker as senior director of the Global Business Policy Council (GBPC), a forum of CEOs and thought leaders focused on assessing global strategic opportunities and risk management. Since 1992, the GBPC has provided A.T. Kearney with a unique platform for delivering global business environment insights to its clients.

Walker, 59, was most recently editor-in-chief emeritus of United Press International and also served as international correspondent and editor-in-chief since joining UPI in 2000. Prior to UPI he spent more than 25 years as a reporter, columnist, foreign correspondent and assistant editor of Britain’s The Guardian newspaper. He will be based in Washington, D.C.

Walker’s insights on economics, politics and current affairs have been featured in some of the world’s most prominent publications including The New York Times, The Washington Post, The Times of London, Die Zeit of Germany and El Mundo of Spain. He also is a regular guest on CNN and Fox News, on CNN’s Crossfire and Capital Gang; The McLaughlin Group; PBS-TV Washington Week in Review; NPR’s Diane Rehm Show and On the Media; and public affairs shows on the BBC, ABC (Australia) and in Canada.

“Martin’s keen intellect and broad perspective on economics and world affairs uniquely position him to lead the direction and strategic initiatives of the Global Business Policy Council,” said Paul Laudicina, managing officer and chairman of A.T. Kearney. “A.T. Kearney clients have come to rely on the Council for the insights they need to meet today’s leadership challenges. Martin’s appointment ensures the Council will continue to play an essential role in helping business and government leaders monitor and understand global macroeconomic, geopolitical, socio-demographic and technological changes.”

Walker has been on the faculty of the Global Business Policy Council since 1997. He is the author of more than a dozen books including “The Cold War: A History” (1993) and “Europe in the New Century: Visions of an Emerging Superpower”. He also is a senior scholar at the Woodrow Wilson International Center for Scholars in Washington and a senior fellow of the New School University in New York.

Walker regularly chairs Council on Foreign Relations events in New York and Washington, and has been a guest lecturer at Chatham House, London; Harvard’s Kennedy school; the universities of Columbia, Pittsburgh, Edinburgh, Toronto, Sussex (UK); UCLA, Johns Hopkins School of Advanced International studies and MGU (Moscow State University).

Walker was educated at Balliol College, Oxford, where he was the Brackenbury scholar and took a first-class honors degree in modern history, and at Harvard, where he was a Harkness Fellow and a resident tutor at Kirkland House. He was also a Congressional Fellow of the American Political Science Association, and served as an aide to U.S. Senator Edmund Muskie.

About A.T. Kearney

A.T. Kearney is one of the world’s largest management consulting firms. With a global presence spanning major and emerging markets, A.T. Kearney provides strategic, operational, organizational and technology consulting services to the world’s leading companies.

A.T. Kearney’s Global Business Policy Council is among the consulting industries longest-standing strategic services for CEOs. The GPBC helps senior business executives and government leaders monitor and capitalize on macroeconomic, geopolitical, socio-demographic and technological change worldwide. Council membership is limited to a select group of corporate leaders and their companies. The Council’s core program includes periodic meetings in strategically important parts of the world, tailored analytical products, regular member briefings, and other services.

Ten economies are becoming the new locomotive for the global economy By Martin Walker Senior Director of A.T. Kearney’s Global Business Policy Council.

Ten economies are becoming the new locomotive for the global economy By Martin Walker Senior Director of A.T. Kearney’s Global Business Policy Council.