By JOE PARKINSON And AYLA ALBAYRAK

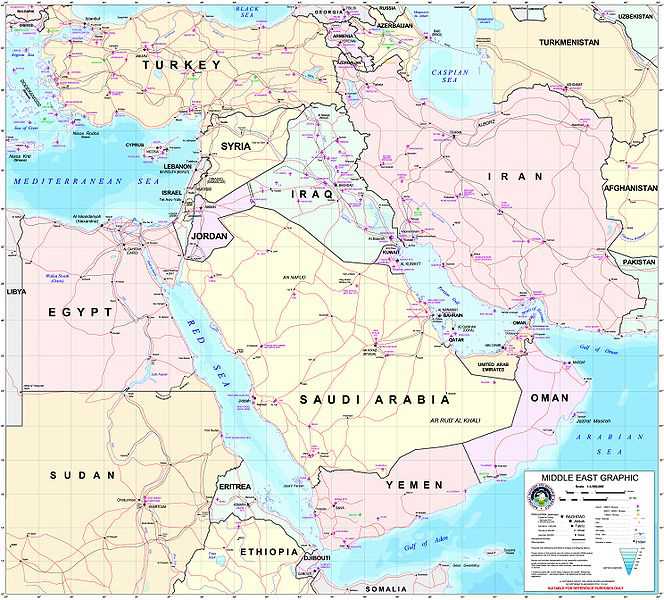

ISTANBUL—Turkish Prime Minister Recep Tayyip Erdogan said his government will move the country’s top public financial institutions from the capital, Ankara, to Istanbul as part of a strategy to promote the commercial hub as an international financial center.

Members of his ruling Justice and Development Party, or AKP, have proposed to also move the central bank to Istanbul—setting up the institution as the next battleground to shape the nation’s future between old-guard secularists and the country’s Islamic-leaning government.

In a speech in Istanbul to mark the Turkish stock exchange’s 25th anniversary, Mr. Erdogan, an Istanbul native, said plans to move the country’s financial regulators and several state-owned banks, “cannot be delayed any longer.” Turkey’s official news agency, Anandolu Ajansi identified the banks as TC Ziraat Bankasi AS, Turkiye Vakiflar Bankasi TAO and Turkiye Kalkinma Bankasi.

Mr. Erdogan didn’t mention the central bank. The AKP has put the central bank move on hold in the face of resistance from political opponents.

“It won’t happen now because of opposition,” said Nurettin Canikli, AKP Deputy Chairman, in a phone interview. “The goal now is to pass this before the elections next year.” Parliamentary elections are due to be held in June.

Opposition parties see relocating the Central Bank of the Republic of Turkey as a first step in a bid by the government to move the entire capital from Ankara.

Modern Turkey’s founder Mustafa Kemal Ataturk moved the capital to Ankara from Istanbul in order to make a clean break with the Ottoman Caliphate.

“The central bank is a symbol of national sovereignty, moving it to Istanbul would be a message against the Republic.…Istanbul was the capital city of the Ottoman Empire and the prime minister has a certain yearning for that,” said lawmaker Akif Hamzacebi of the Republican People’s Party.

Mr. Canikli said such opposition was “ideological, it has no basis in economic realities.” The government hasn’t proposed moving the capital.

Central Bank Governor Durmus Yilmaz also has opposed previous efforts to move the bank to Istanbul, arguing that the bank’s place is close to the national treasury to better coordinate in times of crisis.

Still, many in Turkey’s financial community believe the move is virtually assured. “It will actually be a surprise if they don’t move,” said Murat Yulek, managing director of PGlobal Global Advisory Services, a finance consultancy, and board member of TAIB, a Turkish investment bank.

Mr. Canikli said the central bank’s new premises would be housed in a purpose-built finance park on the Asian side of the Bosphorus strait, which splits Istanbul between East and West. Also in the new complex would be the relocated financial regulators and a new Istanbul stock exchange building. Mr. Canliki said land has already been allocated.

A spokesman for the central bank declined to comment on proposals to shift the bank, or on the proposed location.

Moving the central bank would put Turkey at odds with most large economies, which usually base their monetary authorities in national capitals, but would hardly be unprecedented. Germany and India both have their central banks in their commercial, not political, capitals.

Opposition lawmakers say the move is far from inevitable, noting that they successfully blocked previous AKP efforts to move the bank since Mr. Erdogan first proposed the relocation in 2006. But the case has been strengthened over the past year, as Istanbul provided the engine of a consumer-led recovery that saw Turkey tie China as the fastest-growing economy in the second quarter, at a 10.3% expansion.

According to a Brookings Institution report, Istanbul ranked above four Chinese cities as the world’s most dynamic metropolitan center, posting a 7.3% gain in employment and 5.5% rise in gross value added per person—a proxy for income—over the past year.

Write to Joe Parkinson at [email protected]

via Turkish Leader Moves Big Banks to Istanbul – WSJ.com.