Companies in Iran are finding their way to the world economy through Turkey, developing strong trade ties in recent years, according to a Turkish business representative.

“Turkey is replacing Dubai for Iranian firms,” Bilgin Aygün, the vice chairman of Turkish-Iranian Business Council at Foreign Economic Relations Board of Turkey, or DEİK, told the Hürriyet Daily News & Economic Review on Monday. “The best of Iranian firms penetrate world markets through Turkey,” he said, noting that cultural, historical and religious links go back hundreds of years as well as Iranian firms’ interest in Turkey.

“Many Iranian firms with warehouses in Dubai are now considering Turkey due to the geographical advantages it offers,” he said, adding that direct flights offered by Turkish Airlines to four Iranian cities have paved the way for business growth between the two countries.

According to figures from the Turkish Prime Ministry’s Undersecretariat of Treasury, the number of Iranian firms in Turkey reached to 1,470 by the end of last year. The figure for the years between 1954 and 2002 was only 319.

Starting from 2002, the year that Turkey’s ruling Justice and Development Party, or AKP, came into power, every year nearly a hundred new Iranian firms started to operate on Turkish soil. Iranian firms’ interest in Turkey even continued during the global recession and 139 new firms were registered in Turkey in 2008.

According to figures, 167 Iranian firms started to operate in the country in 2009 before a record-breaking sum of 284 last year.

The total capital of top 74 Iranian companies out of 167 that were registered in Turkey in 2009 was between $50,000 and $200,000. The capital of only seven Iranian companies that registered in the country was above $500,000. In 2010, the capital of 284 new Iranian companies in the country summed up $9.83 million.

“Bilateral trade volume has increased 50 percent as of the end of last year,” Aygün said.

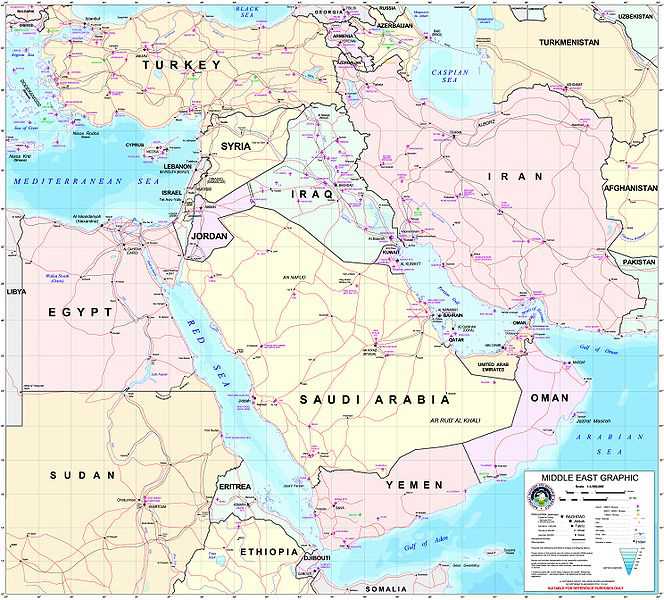

It was “considerably” easier for Turkish businessmen to work with Iranian firms as almost one in every three speaks Azeri, a dialect similar to Turkish, said the vice chairman. “Turkey could penetrate eastern markets through Iran while Iran penetrates western markets through Turkey.”

Energy trade

Turkish dependency on energy imports has increased the strategic importance of Iran for the country, Aygün said. “Turkey and Iran could join forces and invest in third countries, especially in Tajikistan and Afghanistan that are strongly under the influence of Iran.”

He said an Iranian business delegation would visit Istanbul in September to meet with Turkish businessmen to negotiate the possibility of investment in third countries. “A Turkish business delegation from DEIK would visit Tehran for the same purpose in April 2012.”

Turkey’s oil imports reached 7.8 million tons in 2008 and slumped down to 3.2 million tons in 2009. According to Energy Market Regulatory Body, or EPDK, Turkey’s total import of oil from Iran reached 5.3 billion tons by the end of last year. Natural gas import of Turkey reached 5.2 million cubic meters by the end of last year from 4.1 million cubic meters in 2008 and 5.2 million in 2009.

More border gates

Turkey and Iran opened a third border crossing at Kapıköy in eastern province of Van province last Saturday. Speaking at the opening ceremony, Turkish Foreign Minister Ahmet Davutoğlu said, “Our prime minister set a target of $30 billion in annual trade with Iran. That is why we are opening this border crossing.”

“This border is a symbol of peace and friendship and the resurrection of the Silk Road, which for centuries played an important role in making the economy of the region flourish,” said Foreign Minister Ali Akbar talking at the ceremony.

According to Turkish Prime Minister the economic relations between two countries would be boosted with a fourth border to be opened in Dilucu in northeast of Turkey and a fifth crossing border in Dillucu in northeastern Turkey without giving a date for opening.

“Iran’s foreign trade volume is approximately $150 billion,” Mehmet Koca, chief executive officer of Gübretaş, told the Daily News.

The Turkish fertilizer acquired Iran’s Razi Petrochemical in 2008 for $656 million euros. Noting that the business opportunities between the two countries had tremendous growth potential, Koca said, Turkish and Iranian trade volume floats around $10 billion as the total foreign trade volume of Iran has reached approximately $150 billion by last year.

Koca said Turkey has nearly a $3 billion share in Iran’s total imports of $60 billion last year. According to Koca, “The figures show that Iran meets nearly 95 percent of its import demand from countries other than Turkey.”

“In recent years, with the attempts of the Turkish government, Turkey has improved trade relations with Iran,” said Koca, noting that economic relations gained new momentum thanks to increasing political and economic influence of Turkey in its hinterland. Koca said the current trade volumes are still way below the potential, in order to accelerate the economic relations, “Iran’s approach to the world carries significant importance.”

“The new border crossings taking place between two countries, Iranian firms opening new firms in Turkey in order to penetrate worldwide economies through Turkey demonstrate that the economic relations between Iran and Turkey have developed to a great extent,” said Koca.

Turkey’s total trade volume with Iran reached $10.6 billion by the end of last year, according to Turkish Statistical Institute, or TurkStat. Turkey’s total export volume to Iran reached nearly $3 billion in last year rose from nearly $2 billion of 2009. Turkey’s import volumes also skyrocketed to $7.64 billion in 2010 compared with $3.4 billion in previous year.