June 11, 2013, 4:42 p.m. EDT

By Kate Gibson, MarketWatch

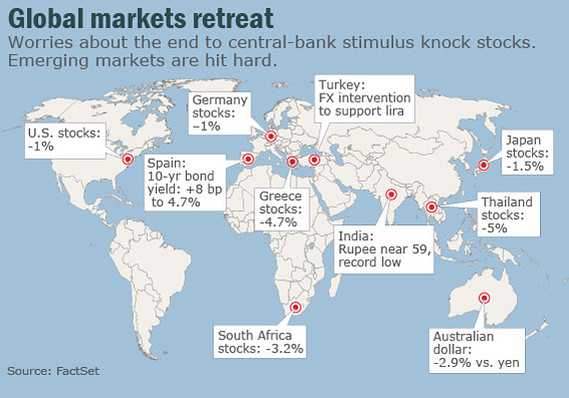

NEW YORK (MarketWatch) — U.S. stocks declined sharply Tuesday after the Bank of Japan opted to hold its monetary policy steady, raising concerns that central banks will not provide additional economic stimulus.

The U.S. Federal Open Market Committee and Fed Chairman Ben Bernanke “have introduced volatility into the market for the first time this year, and part of it has to do with when quantitative easing will start to taper, and that has caused a cascade of opinions as to when that will be and what that should mean for stocks,” said Art Hogan, market strategist at Lazard Capital Markets.

Central bank inaction rattles markets

Paul Vigna and Matthew Walter discuss the latest on markets.

Investors have been watching U.S. economic data closely for any clues as to when the Federal Reserve may begin to scale back its $85 billion in monthly bond purchases.

“It does feel like in the last couple of weeks, news has been affecting all markets, not just regional,” said Richard Slinn, an investment specialist at J.P. Morgan Private Bank in San Francisco.

“As [10-year Treasury] yields (ICAPSD:10_YEAR) rise and as that volatility increases, we’ve been rotating,” Slinn says of investors swapping into varying asset classes.

On Tuesday, the 10-year Treasury yield traded at 2.183%.

Along with Asian and European stocks, the dollar fell sharply against the Japanese yen (ICAP:USDJPY) after the Bank of Japan decided to stay put on its policies, dashing some hopes that the central bank would extend the duration on its ultra-low interest rates to banks.

Boring stocks, exciting returns

In the stock market, boring is often beautiful. Mark Hulbert joins MoneyBeat to discuss why volatility is overhyped. Photo: AP.

Extending losses into a second session, the Dow Jones Industrial Average (DJI:DJIA) fell as much as 152 points before briefly turning positive, then finished with a 116.57-point, or 0.8%, loss at 15,122.02 with American Express Co. (NYSE:AXP) pacing declines that included all but three of its 30 components.

The S&P 500 index (SNC:SPX) dropped 16.68 points, or 1%, to 1,626.13, with the financial sector hardest hit among its 10 major industries.

The Nasdaq Composite (NASDAQ:COMP) slid 36.82 points, or 1.1%, to 3,436.95.

For every stock rising, half a dozen fell on the New York Stock Exchange, where almost 689 million shares traded.

Composite volume surpassed 3.3 billion.

Gold futures (CNS:GCQ3) shed $9 to $1,377 an ounce and crude (NMN:CLN3) fell 39 cents to $95.38 a barrel on the New York Mercantile Exchange.

Inventories at U.S. businesses climbed 0.2% in April to $504.8 billion, the Commerce Department reported Tuesday. Separately, the Labor Department said job openings at U.S. workplaces fell to 3.76 million in April from 3.88 million in March.

Wall Street stocks finished Monday’s session little changed after Standard & Poor’s revised its U.S. credit-rating outlook to stable from negative. On Monday, the Dow finished down 9.53 points, or 0.06%, to 15,238.59, and the S&P 500 dipped 0.57 point to 1,642.81.

In Tuesday trading, shares of Dole Food Co. (NYSE:DOLE) jumped 22% after David H. Murdock, the company’s chairman and CEO, made a bid for the rest of Dole. Murdock controls almost 40% of Dole Food, and the $12-per-share cash offer represents an 18% premium to Dole Food’s closing price on Monday of $10.20 per share.

Shares of Lululemon Athletica Inc. (NASDAQ:LULU) tumbled 18% a day after the yoga-clothing retailer announced quarterly results and said its Chief Executive Christine Day will step down.

Shares of Sprint Nextel Corp. (NYSE:S) rose 2.4% after SoftBank Corp. said it would raise its offer for Sprint to $21.6 billion from $20.1 billion.

Read them & join the conversation

Markets