Aug 29, 2018 | 09:00 GMT

(ADEM ALTAN/AFP/Getty Images)

Highlights

- As it reinstates sanctions on Iran, the United States will try to close loopholes in the measures that Tehran has previously exploited to make it more difficult for other countries such as Turkey to continue trading with the Islamic republic.

- The currency and debt crises facing the Turkish economy will make banks and companies reluctant to risk defying the measures and incurring the associated costs.

- The Turkish administration’s desire to challenge the United States on sanctions and tariffs won’t outweigh these concerns for most firms and financial institutions.

Editor’s Note: This assessment is part of a series of analyses supporting Stratfor’s upcoming 2018 Fourth-Quarter Forecast. These assessments are designed to provide more context and in-depth analysis on key developments to watch in the coming quarter.

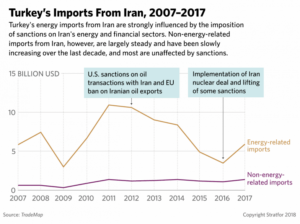

The U.S. government is rolling out its toughest sanctions yet on Iran to try to pressure Tehran to change its behavior. In the process, it’s forcing the countries that do business with the Islamic republic to make a tough choice: Fall in line with the United States or continue trading with Iran. The dilemma is especially difficult for Turkey, which, despite centurieslong rivalry with Iran, depends on the country for much of its oil and natural gas needs. Ankara recently announced that it would try to increase its trade with Iran from $10 billion per year in 2017 to $30 billion per year, notwithstanding the wave of new sanctions on Tehran set to take effect in November. Turkey’s financial problems, however, will limit the extent to which its government can push back against Washington.

The Big Picture

A new round of U.S. secondary sanctions will take effect on Iran in November, restricting financial transactions, trade and investment with the country. A few months out, some of Iran’s biggest trading partners are already slowing down their activities with the Islamic republic to avoid the expense of breaking the measures. The Turkish government will try to resist the new sanctions in its effort to undermine the U.S. strategy in the region. But the country’s economic problems will compel Turkish companies and banks to fall in line with the measures.

See Rebalancing Power in the Middle East

See Turkey’s Resurgence

Closing the Loopholes

Turkey is no stranger to navigating sanctions against Iran. In 2012, facing a U.N.-backed multilateral sanctions regime, it curtailed its trade with the Islamic republic, which fell from a high of $22 billion that year to $14 billion in 2014. (The collapse of global oil prices contributed to the sharp decline.) The move hampered investments between the two countries, though Turkey found ways to continue trading for Iranian goods, such as bartering or paying in local currencies. It also could keep importing natural gas from Iran, since those purchases were not subject to sanctions, an arrangement that gave the Islamic republic much-needed access to foreign currency. Ankara routed payments for natural gas through Halkbank, a major Turkish bank. Iran used the money to buy Turkish gold, which it then exchanged for currency through another institution in what became known as the “gas for gold scheme.”

This time around, the United States is taking steps to close some of the loopholes that enabled Turkey to maintain its trade ties with Iran. Washington, for example, is clamping down on gold transactions and keeping a closer eye on the re-export terminals that Iran has used to exchange goods with countries such as Turkey, Oman and the United Arab Emirates. Unlike in 2012, moreover, the U.S. government today looks unlikely to issue waivers for the sanctions on Iranian oil exports. Turkey’s oil refiner, Tupras, already has begun decreasing its crude oil purchases from Iran in anticipation of the measures’ November effective date. (The sanctions on natural gas exports are gentler by comparison, in part because Iranian natural gas is important for Europe.) And for its role in flouting the earlier sanctions, Halkbank is now tied up in a legal battle with the state of New York. The Turkish government, however, has not quite yielded to the U.S. sanctions pressure. Economy Minister Nihat Zeybekci promised that Ankara would defy the restrictions and “continue to trade with Iran as much as possible.”

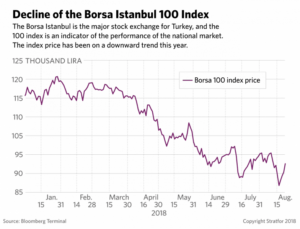

A Risky Scheme

But opposing Washington is a risky strategy for Ankara. For one thing, relations between the two have been steadily deteriorating under the strain of issues such as the Trump administration’s steel and aluminum tariffs, Turkey’s ties with Russia and the Turkish government’s arbitrary arrests of U.S. citizens. The United States, in fact, has taken the unprecedented step of sanctioning Turkish officials for the continued detainment of an American pastor, Andrew Brunson. For another, Turkey’s economy is in disarray. The return of secondary sanctions on Iranian energy exports could add to its troubles by driving up the price of oil and, in turn, driving up domestic inflation while depressing the lira’s value. Facing a currency and debt crisis, the country’s banks and companies cannot afford to pay the price of disregarding U.S. sanctions. Ankara will try to offset the potential damage by extending loan maturities, for example, or making it easier to repackage debt, but its efforts won’t be enough to reassure most Turkish banks, since about half of their deposits are in U.S. dollars.

Nevertheless, trade will continue between Turkey and Iran. Turkey’s Ziraat Bank has arranged for a currency swap with Iranian Bank Melli that will enable $1.4 billion worth of trade between the two countries — the most advanced exchange Tehran has arranged so far with any trade partners. Some smaller Turkish companies will also try to cash in on the lucrative opportunity that circumventing the measures presents, though most will probably decide against it. Even if they don’t stop trade between Iran and Turkey, after all, the tougher U.S. sanctions will at least make it harder.

Connected Content

- Turkey: Cracking Down on Sanctions Violations, Washington Wounds Ankara Jan 04, 2018 | 21:01 GMT

- Iran’s Strategy for Surviving U.S. Sanctions May 30, 2018 | 20:05 GMT

- Turkey: Kurds, Iran and Prodding the United States Mar 08, 2017 | 08:03 GMT

- Copyright ©2018 Stratfor Enterprises, LLC. All rights reserved.

Leave a Reply