In the minefield of the global arena, Turkey, the 15th largest economy in the world, should be marked as the next contender for a financial crisis. If the past is the prologue of its economic disequilibrium, demography trend and history announce loud and clear a future destabilization that could beyond a financial crisis.

An unstable economy

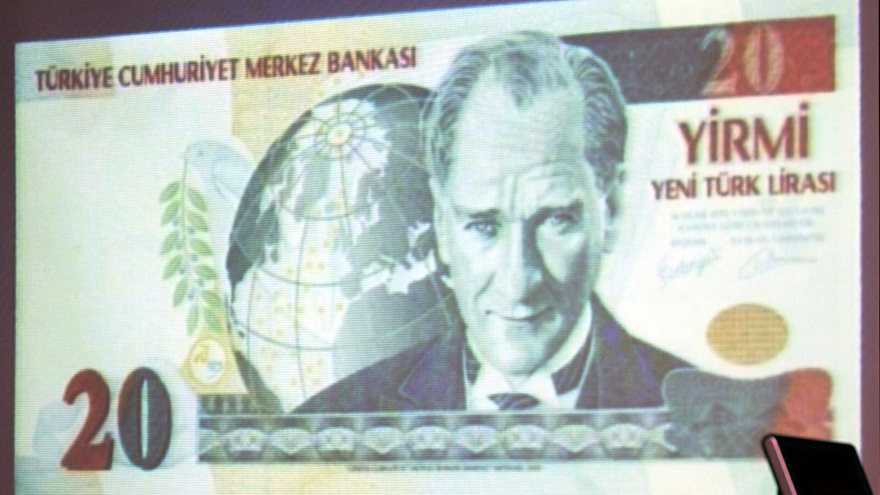

Turkey has had record of high inflation and high public debt, but in 2003 it eliminated six zeros in its currency by issuing a redenominated Turkish Lira, commonly known as the second Turkish Lira, which brought a period of temporal stability to the economy.

The economy booms

The second Turkish Lira brought price stability and global investment to Turkey carrying the illusion that lower interest rates, higher fiscal income and lower public debt to GDP positioned the country as a stable nation. Turkey has even been qualified as emerging economy by the IMF, but the truth is that its economic disequilibriums are unsustainable and growing.

From emerging to emergency

Such a high growth track is not sustainable because their Current Account suffers a massive trade deficit, which jumped to 10% of GDP in 2011. That has been attenuated by an initial devaluation of the Lira making it close to 7% of the GDP but growing indicating that the problem is structural. This path is leading to a currency crisis that will bring higher inflation and unemployment, a higher public deficit and higher public debt putting the country at the doors of a sovereign debt crisis. In fact, the figures of Current Account deficit, Public Debt and Public Deficit are almost a mirror image of the Spanish ones during the year its real estate bubble burst.

The day of reckoning will bring to Turkey a strong devaluation of its currency, which could have at least two devaluation stages with a loss pattern close to 0.4 Lira per dollar, until the economy stabilizes if it finally does. I don’t think that Turkey’s $118 million dollars in reserves, $18 million in gold, with a Current Account deficit close to $60 billion per year will be enough for an orderly devaluation without a strong fiscal adjustment to reduce consumption and imports.

The population bomb is ticking

In 1945, Turkey had a population similar to Spain’s in 1905; now it has almost doubled and will soon be larger than Germany. The necessary adjustment will probably leave the country with a structural unemployment that could be over 15%, if we believe the official figures. This will aggravate a per se unstable nation that has a young population and additionally suffers the costs of a refugee crisis from the Syrian war.

In modern times, Turkey has always seen the European Union as a solution to its need for growth. But the truth is, the EU cannot absorb the cost of its full membership, which is something that Turkey does not seem to understand. Meanwhile, the problem grows and the solutions frustrate Turkish citizens, pushing them to refuse membership to the West and radicalizing the Otomanism of the current government if a Turkish Spring were to explode.

In the middle of nowhere?

It remains even more uncertain how Turkey will react to a large succession of adverse events given its geopolitical situation, its long history of changing alliances (of which the flotilla is just a small appendix), its frustration with the EU rejection after 54 years of negotiation, and its renewed sight to the East,

Imagine that a Turkish Spring radicalizes the government and induces it to join theShangai Cooperation Organization, which may induce it to leave NATO, where Turkey is, by now, just a mere observer. It could transform a financial crisis into a major geopolitical shift for the world. That would be a Black Swan.