Turkey will not be swayed by US sanctions pressure to halt gold exports to Iran but Tehran’s demand for the metal may fall this year, said its Economy Minister Zafer Caglayan, Trade Arabia reported with a link to Reuters.

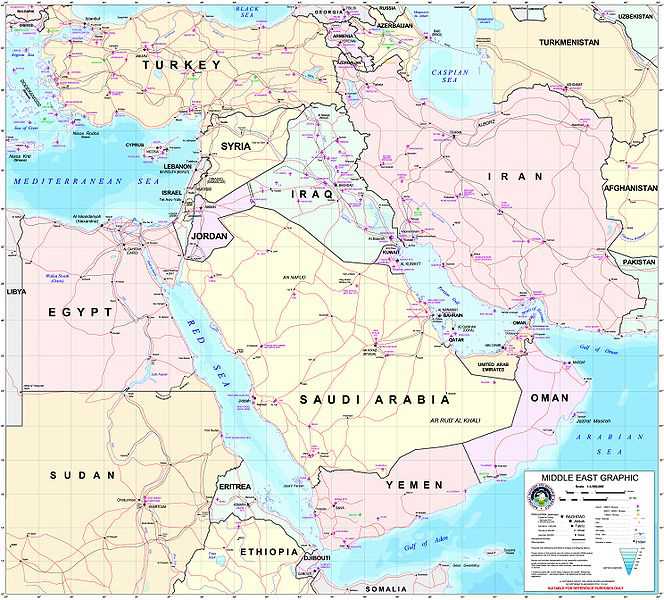

US officials are concerned that Turkey’s gold sales, which allow Iran to export natural gas, provides a financial lifeline to Tehran, which is largely frozen out of the global banking system by Western sanctions imposed over its nuclear programme.

Trade in Turkish gold bars to Iran via Dubai is drying up as banks and dealers increasingly refuse to buy the bullion to avoid sanctions risks associated with the trade.

Turkey has a six-month US waiver exempting it from financial sanctions against Iran, which is due to expire in July.

“We will continue to make our gold exports this year to whoever seeks them. We have no restrictions and are not bound by restrictions imposed by others,” the Turkish minister told reporters.

“There may be a decline in demand for gold exports. This is nothing to do with sanctions. We are not subject to these sanctions until July anyway, but there may be a decline in demand from Iran,” he said.

Caglayan declined to say why he anticipated Iranian demand might fall.

Turkey, Iran’s biggest natural gas customer, has been paying the Islamic Republic for oil and gas imports with Turkish liras, because sanctions prevent it from paying in dollars or euros.

Iranians then buy gold in Turkey, and couriers carry bullion worth millions of dollars in hand luggage to Dubai, where it can be sold for foreign currency or shipped to Iran.

Caglayan, who has repeatedly said that Turkey’s gold trade with Iran is carried out by private firms and is not subject to US sanctions, said other firms, including US and European companies, were continuing their exports to Tehran.

“Turkey is doing whatever is required by international obligations. The companies of those imposing an embargo on Iran today, forbidding product exports to Iran, are exporting to Iran under different guises,” he said.

The US State Department said in December that diplomats were in talks with Ankara over the flow of gold to Iran after the Senate approved expanded sanctions on trade with Iran’s energy and shipping sectors, which would also restrict trade in precious metals.

That increasing US pressure has already started to create troublesome repercussions for exporters of Turkish gold.

The spotlight on the gold-for-gas exchange contributed to a cut in Turkey’s gold exports to the UAE to some $400 million in December from nearly $2 billion in August, according to the latest official trade data.

Separately, Caglayan said Turkish state-owned Halkbank will continue its existing transactions with Iran but some other banks, with activities in the United States, had pulled back in response to US pressure.

Asked about a decision by India no longer to use Halkbank to pay for its Iranian oil imports, he said: “This is India’s decision not Halkbank’s.”

A Turkish official told Reuters that trade with Iran through a third party was no longer allowed under tighter US sanctions which went into effect on Wednesday.

“For example, Halkbank would not be able to be an intermediary in India’s oil purchases from Iran,” he said.

via Turkey says won’t halt gold flow to Iran – Trend.Az.

Leave a Reply