Are the CIVETS group of countries the next big investment opportunity or nothing more than a convenient acronym?

By JOHN GREENWOOD

Ten years after Brazil, Russia, India and China were dubbed the BRICs, any early mover advantage for investing in them has long gone.But lovers of acronyms will be relieved to learn the latest investment theme claiming to steal a march on emerging markets also has a catchy name.

Journal Report

Read the complete Wealth Adviser report.

The CIVETS group of countries—Colombia, Indonesia, Vietnam, Egypt, Turkey and South Africa—are being touted as the next generation of tiger economies, even if they are named after a rather more shy and retiring feline. They all have large, young populations, with an average age of 27. This, or so the theory goes, means the countries that make up CIVETS will benefit from fast-rising domestic consumption. They are also all fast-growing, relatively diverse economies, which means, unlike the BRICs, they should be less heavily dependent on external demand.

HSBC Global Asset Management launched the first fund specifically targeting the group of countries, its GIF CIVETS fund, in May. HSBC points to rising levels of foreign direct investment across the CIVETS grouping, low levels of public debt—with the exception of Turkey—and sovereign credit ratings improving towards investment grade. Critics point out that CIVETS countries have nothing in common beyond their youthful populations. Furthermore, liquidity and corporate governance are patchy and political risk remains a factor, particularly in Egypt.

“This sounds like a gimmick to me,” says Darius McDermott, investment expert at Chelsea Financial Services. “What does Egypt have in common with Vietnam? At least the BRIC countries were the four biggest emerging economies so there was some rationale for grouping them together. A general emerging markets fund would be a less risky way to get similar exposure.”

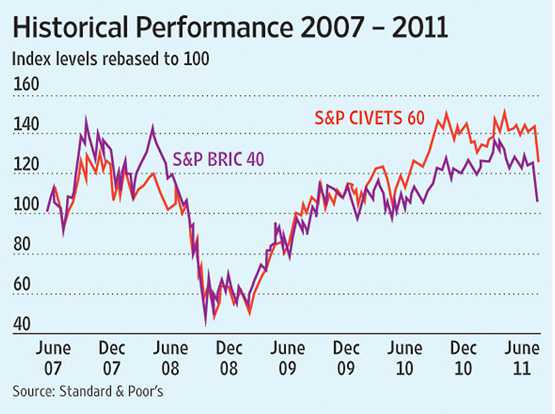

But early numbers suggest that while Colombia, Indonesia, Vietnam, Egypt, Turkey and South Africa make strange bedfellows, CIVETS investors could prosper. Although it was only established in 2007, the S&P CIVETS 60 index is ahead of the S&P BRIC 40 and S&P Emerging BMI over one and three years. While investing in acronyms is not always the most sensible approach, it seems the CIVETS might just pay off.

Colombia

Colombia is emerging as an attractive destination for investors as it works to distance itself from its troubled past. Elected in 2010, President Juan Manuel Santos has continued the center-right policies of former President Alvaro Uribe, prioritizing security and attracting overseas investors.

Improved security measures have led to a 90% fall in kidnappings and a 46% cut in the murder rate over the last decade, which has helped per capita gross domestic product to double since 2002. Meanwhile, Colombia’s sovereign debt was promoted to investment grade by all three ratings agencies this year.

With a population of 46 million, Colombia has substantial oil, coal and natural gas deposits. Other industries include textiles, coffee, nickel and emeralds.

Foreign direct investment stood at $6.8 billion (€4.8 billion) in 2010, with the U.S. its principal partner.

HSBC Global Asset Management sees potential in Bancolombia, the country’s largest private bank, which has turned in a return on equity over 19% for each of the last eight years.

Indonesia

The world’s fourth-most populous nation, Indonesia’s massive domestic consumer market helped it weather the global financial crisis better than most. Turning in a GDP growth rate of 4.5% in 2009, it bounced back above the 6% mark the following year and is predicted to stay there for the next few years at least. Its sovereign debt rating has risen to one notch below investment grade in the last year.

With the lowest unit labor costs in the Asia-Pacific region and a government ambitious to emerge as a credible manufacturing hub it is no surprise some analysts see this country of 240 million people as the next BRIC.

But corruption remains a problem and fund managers see exposure best achieved through local subsidiaries of multinationals. Andy Brown, investment manager at Aberdeen Asset Management holds Astra International, an auto conglomerate that is majority-owned by Jardine Matheson Group. “We expect Astra International to benefit from the strong growth in domestic consumption, particularly through the sale of motorbikes,” says Mr. Brown.

Vietnam

Vietnam has been one of the fastest growing economies in the world for the past 20 years, with the World Bank projecting 6% GDP growth this year rising to 7.2% in 2013. Its population of 90 million and proximity to China have led some analysts to describe it as a potential new manufacturing hub.

But while communist Vietnam has been moving away from a centrally planned economy for some years now, it only became a member of the World Trade Organization in 2007 and foreign investors still face significant obstacles. “The reality is that investing in Vietnam is still a very laborious process,” Mr. Brown says.

Cynics suggest Vietnam is better viewed as a holiday destination than an investment opportunity and it is only included within the CIVETS to make the acronym work. Even HSBC’s fund only has a 1.5% target allocation to the country. It currently holds Vietnam Dairy (Vinamilk), which it sees as well positioned to benefit from Vietnam’s 10% a year growth in demand for dairy products.

Egypt

Revolution may have put the brakes on the Egyptian economy for the moment, but analysts expect it to regain its growth trajectory as soon as political stability returns.

The World Bank is predicting growth of just 1% this year as a consequence of Egypt’s part in the Arab Spring. That compares to 5.2% last year and pre-recession levels of 7% or more. But whenever normal business is resumed, Egypt will be in a position to capitalize on its many advantages. These include fast growing ports on the Mediterranean and Red Sea linked by the Suez Canal and its vast untapped natural gas resources. Some analysts describe it as “the new Turkey”.

As with other CIVETS countries, Egypt has a big, young population—82 million strong and with a median age of 25. Aberdeen Asset Management sees bank NSGB, a subsidiary of Société Générale, as well positioned to take advantage of Egypt’s underdeveloped domestic consumption, importing a model it runs in Eastern Europe. “There is a structural under-penetration of people borrowing money in Egypt,” Mr. Brown says.

Turkey

Located between Europe and major energy producers in the Middle East, Caspian Sea and Russia, Turkey’s growth prospects look strong. The World Bank expects GDP growth of 6.1% this year, falling back to 5.3% in 2013. That said, its economy contracted 4.7% in 2009, revealing its vulnerability to external shocks.

Turkey has relatively few natural resources of its own, but it has a diversified economy as well as major natural gas pipeline projects which make it an important energy corridor between Europe and Central Asia.

“Turkey is a dynamic economy that has trading links with the European Union but without the constraints of the euro zone or EU membership,” says Phil Poole of HSBC Global Asset Management.

Mr. Poole rates national air carrier Turk Hava Yollari as a good investment, while Mr. Brown prefers domestic consumption plays through fast-growing retailer BIM, which has grown from 21 to over 2,600 stores in 15 years, and Anadolu Group, which owns brewer Efes Beer Group.

South Africa

Already the most developed country on the continent by a long way, South Africa has become a diversified economy, being rich in resources like gold and platinum and also attracting manufacturing investment.

Rising commodity prices, renewed demand in its automotive and chemical industries and spending on the World Cup have helped South Africa back into growth after it slipped into recession during the global economic downturn.

Developed world-standard financial, legal and accounting institutions mean corporate governance is of as high a standard in South Africa as in any other emerging market country. They also make the country a gateway to investment into the rest of Africa.

HSBC Global Asset Management sees long-term growth potential in mining, energy and chemical firm Sasol. South Africa’s fast-growing middle class makes domestic consumption an attractive theme, says Mr. Brown. He favors Massmart, the retailer Walmart bought 51% of earlier this year.

https://www.wsj.com/articles/SB10001424053111904716604576544492334928256