By Tulay Karadeniz

and Ibon VillelabeitiaPosted 2010/10/21 at 1:31 pm EDT

ANKARA, Oct. 21, 2010 (Reuters) — A top U.S. government official prodded Turkey on Thursday to enforce international sanctions against Iran, increasing pressure on Ankara to scale back its flourishing trade ties with its neighbor.

“All we want is the sanctions to be imposed throughout the world,” Stuart Levey, the treasury undersecretary for terrorism and financial intelligence, told Turkish broadcaster NTV after meeting Turkish government and banking officials for two days to discuss U.S. and U.N. sanctions.

“The purpose of this visit is to maximize our chances that the sanctions imposed on Iran are successful,” Levey was quoted by the Hurriyet Daily News as telling a group of journalists.

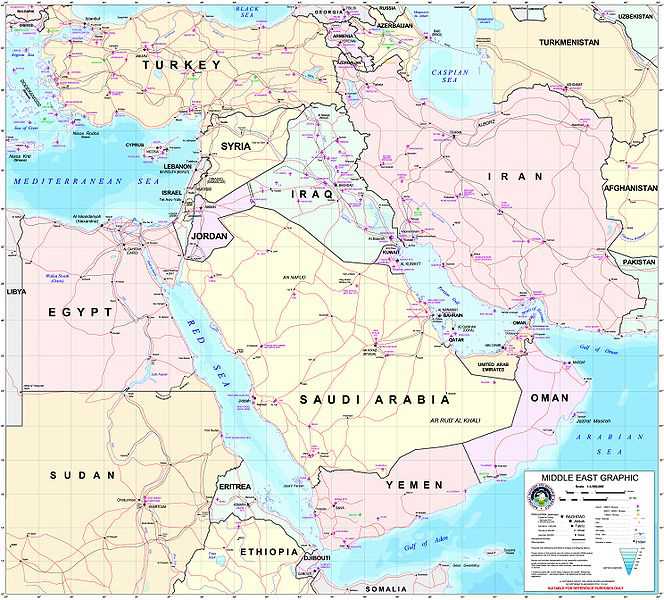

“Turkey of course plays an important role given its proximity to Iran as a neighbor. Implementation of the sanctions here is as important as it is everywhere.”

A U.S. delegation visited Turkey in August to deliver a similar message to the country’s banks.

Turkey, a NATO member that aspires to join the European Union as well as a secular Muslim nation straddling Europe and Asia, has deepened economic and financial ties with Iran despite Western efforts to put the squeeze on the Islamic Republic.

The U.N. Security Council, United States and European Union have tightened sanctions on Iran over its uranium enrichment program, which Washington fears will be used to develop atomic bombs. Tehran says it wants peaceful nuclear energy only.

Turkey is bound by U.N. sanctions despite voting against them along with fellow rotating Security Council member Brazil and has said it is not obliged to follow non-U.N. sanctions.

But under U.S. law, Turkish banks with business in the United States could face U.S. penalties for dealing with Iranian firms blacklisted by Washington.

Prime Minister Tayyip Erdogan said last month Turkey wanted to triple its trade with Iran — which is Turkey’s second largest supplier of gas — at a time of growing international isolation of the Islamic Republic.

TURKISH BANKS

On Wednesday, Deputy Prime Minister Ali Babacan said in Washington that Turkish banks had become hesitant about dealing with Iran, but Turkey had left decisions on whether to pull back following U.S. and European sanctions up to them.

While saying Turkey would comply with U.N. resolutions, Babacan said Ankara had not provided guidelines to its banking sector on how to deal with financial sanctions imposed by the Washington and the EU.

He also reiterated Turkey’s position that only diplomacy, not sanctions, would change Iran’s stance.

Tehran has defied a series of Security Council resolutions demanding that it shelve enrichment and open up to U.N. nuclear inspectors in exchange for trade and diplomatic benefits.

Levey, in the NTV interview, said: “Deputy Prime Minister Ali Babacan said Turkey will abide by the decision of the U.N. Security Council. We consider this as significant.”

Despite Ankara’s permissive stance toward Turkish firms dealing with Iran, Mustafa Koc, chairman of Turkey’s largest energy-to-banking conglomerate Koc Holding, said Turkish companies were starting to feel the U.S. pressure.

Tupras, Europe’s fourth biggest oil refiner and 51 percent owned by Koc, announced in August that it was no longer selling petroleum products to Iran.

“Tupras’ banking transactions are made in U.S. We are doing business with American Ford and Fiat, and indirectly with Chrysler. We simply can not take such a risk,” Koc told Hurriyet daily earlier this week.

Mark Fitzpatrick, an Iran expert at the London-based International Institute for Strategic Studies, said Turkey was out of synch with world powers regarding Iran, undermining efforts to persuade Tehran to comply with international demands.

“I think it’s one point to talk to the neighbors, to have good relations, to have trade that is not restricted by the U.N. sanctions, but it’s another to send signals to Iran that the outside world is split,” he told Reuters in an interview.

(Editing by Mark Heinrich)

via NewsDailyon Iran.

Leave a Reply