By James Moore, Deputy Business Editor

Saturday, 15 May 2010

Markets suffered another day of wild swings yesterday amid continued concerns over the Greek debt crisis and its effect on the euro.

The latest round of selling was sparked by reports that the French President, Nicholas Sarkozy, had threatened to pull France out of the euro if Germany failed to get onside with a bailout of the heavily indebted Greek economy. The uncertainty was exacerbated when Josef Ackermann, the chief executive of Deutsche Bank, suggested in an interview that Greece might not ever pay back its debts.

The turmoil saw the FTSE 100 ending down 170.8 points at 5262. Across the Atlantic the Dow opened sharply down, while other major European markets finished deeply in the red.

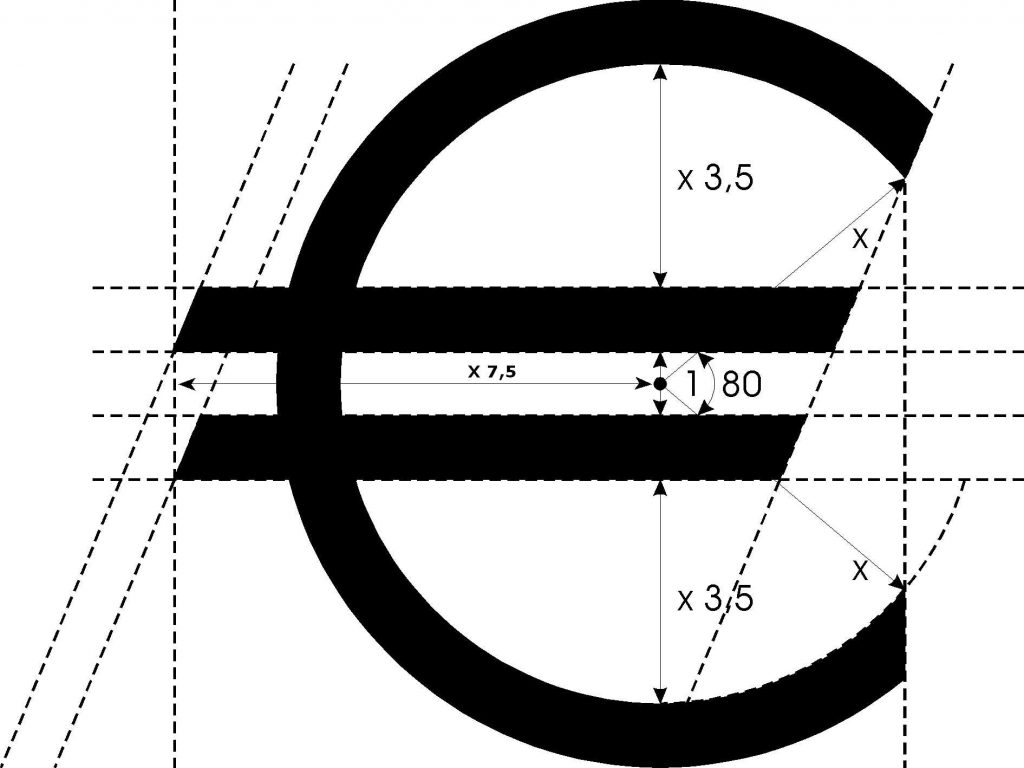

The euro also fell steeply on global currency markets. Against the dollar it dropped under $1.24, to its lowest level since October 2008. The weakness in the euro also meant that the pound gained ground against the single currency, rising nearly 1 per cent, or just over a cent. Since the beginning of 2010, as the debt crisis has worsened, the euro has lost about 13.5 per cent against the dollar.

Yesterday G7 finance ministers held a conference call to discuss the global economic situation and the ongoing crisis. George Osborne, the Chancellor, is understood to have told his counterparts that the Government’s priority is an accelerated outline reduction of Britain’s fiscal deficit. Mr Osborne has promised an emergency budget within 50 days of the new Government taking office.

It came amid speculation that the UK could be the next country to face a speculative attack if the eurozone does stabilise as a result of the Greek bailout. Some commentators have even suggested that France might not be immune from the contagion.

George Buckley, economist at Deutsche Bank, said: “There is still a lot of uncertainty out there and you can’t solve everything with a single package. The coalition looks stable at the moment but there will be disagreements and that has even been recognised by both parties.” He said there was a wider concern throughout Europe: that governments might not act to cut deficits soon enough. “And if they don’t, where do we go next?”

Philip Shaw, economist at Investec, said: “Markets are still concerned that Europe is stalling, and that’s an issue for them, because they are always unsure until some time after governments actually take action to introduce austerity measures and that there is evidence that the measures are actually working.”

Mr Shaw added: “As far as Greece is concerned it is far from clear that it is actually out of the woods. The package covers its financing needs until 2011 but if it fails to implement the [austerity] measures or its economy takes a sharper downturn than was expected, then by next year the country may find it difficult to borrow money at an interest rate that it is prepared to pay.”

Economists say Britain does have several advantages over Greece and other eurozone countries with debt problems such as Spain, Portugal and even Italy, which collectively with Ireland have been given the unflattering acronym of Piigs by economists.

The UK has a floating exchange rate and its debt is much longer-term than Greece. It also has a flexible economy and a stable tax base, which is collected. However, David Buik, partner at BGC Partners, said: “I doubt there is a single person on the planet who can seriously put his hand on his heart and say that he is certain that Greece at the bottom and even the UK can service or repay its debt over the timetables that have been set out. Politicians have simply not been willing to talk about the pain that doing this will inflict.”

The Independent