Today’s Zaman

WASHINGTON — In the last quarter of 2009, State Oil Company of Azerbaijan Republic (SOCAR) and Russian gas giant Gazprom signed a medium-term deal — in the presence of both Azerbaijani President İlham Aliyev and Russian President Dimitry Medvedev — to supply Azerbaijani gas to Russia.

The contract initially envisioned export of about 500 million cubic meters of gas per year.Gazprom’s Web site said the two companies would conduct joint technical inspections of the 200-kilometer Baku-Novo Filya pipeline, which runs along Azerbaijan’s Caspian coast to the Russian border, and ultimately modernize the pipeline. “Azerbaijani gas will be supplied to Russia along this route,” the company’s Web site reported.

A few months later, Gazprom CEO Alexei Miller announced that his company is willing to buy as much Azerbaijani gas as possible. He also mentioned that Gazprom — the world’s biggest natural gas producer — will be paying market prices for Azerbaijani gas. SOCAR’s chief, Rovnag Abdullayev, also expressed his company’s interest in increasing the amount of natural gas sold to the Russian side. Since then, Gazprom has tried to push SOCAR for a long-term gas deal.

At first it seems like a pretty good deal for Azerbaijan since Azerbaijan lacks a direct gas link to Europe and has been unable to agree with Turkey on terms for the transit of larger planned volumes. A SOCAR-Gazprom deal would be an excellent opportunity for Azerbaijanis to sell their gas at market prices right at the “door” without hassling with transit countries such as Turkey and Georgia or waiting for the implementation of the Nabucco pipeline. Thus, Gazprom’s network is the “optimal” route for gas from Azerbaijan to reach Europe.

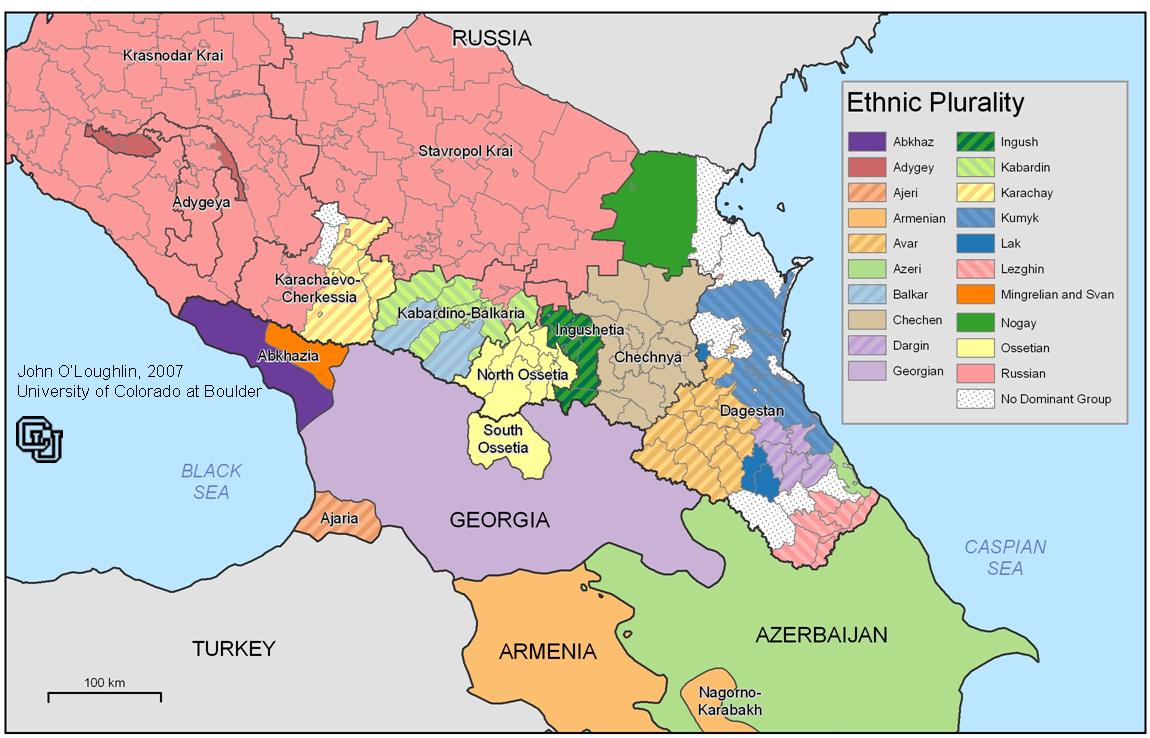

For diversification of export routes and for certain geopolitical and commercial reasons, Gazprom’s offer requires careful examination and analysis by the Azerbaijani side. As of now, Azerbaijan is capable of carrying out its commitments toward exporting approximately 1 billion cubic meters (bcm) to Russia (the Dagestan region) annually. The second phase of Shah Deniz gas production is expected to add 12 billion to 14 billion cubic meters of annual gas output in three to five years once a market is found and transit for the fuel ensured. Committing all possible gas supply to Gazprom beforehand cannot be viewed as a viable option for Azerbaijan.

Azerbaijan may

lose its bargaining power

Early commitments to Gazprom will decrease Azerbaijan’s bargaining power in terms of pricing. Central Asian gas producers Kazakhstan and Turkmenistan had to sell their natural gas for significantly lower prices compared to world market prices because Gazprom was the only buyer. It was only when China became another possible buyer for Central Asian gas that the Russian company offered fairly good prices to Turkmenistan and Kazakhstan.

Along with commercial concerns, geopolitical ramifications of a possible long-term commitment to Gazprom cannot be disregarded. Russia is widely known to use its economic advantage as political leverage in dealing with its neighbors and other countries. In the cold winter of 2009, Russia did not hesitate to cut the gas supply to its consumers in order to push its political agenda forward. Since then, European countries have started looking for alternative natural gas supply routes. Russia’s intransigency forced them to think about their energy security and be cautious in their future dealings with Russia.

In line with this new approach, the Nabucco pipeline has been proposed to create another supply route that is projected to bring about 31 bcm of natural gas to Europe. Gazprom applies different pricing approaches to different countries. The price that is given to Armenia — its closest ally in post-Soviet hinterland — is much lower than the prices given to Ukraine or Georgia, the latter started to import natural gas from Azerbaijan instead. Thus, it is not that hard to see political motivation in Gazprom’s business.

Azerbaijani gas is one of the possible — maybe the most viable — sources to fill the Nabucco pipeline, and it is in Azerbaijan’s utmost interest to diversify its natural gas exporting options. Being a major supplier of the Nabucco pipeline would serve Azerbaijan’s interests, and Azerbaijan can play an important role in European energy security. Currently Azerbaijan’s Shah Deniz is the only deposit mature enough to be considered a base for forming contracts for the Nabucco project.

Russia with the hand of Gazprom is doing its best to cut the possible supply for Nabucco. It takes all re-export expenses and pledges to pay market prices for all future possible Azerbaijani exportable gas, meaning that to re-export Azerbaijani volumes, Gazprom would need to cut production and exports of Russian gas, its main source of profit. This makes Gazprom’s offer a politically motivated rather than commercially viable deal. If Azerbaijan happens to commit all its future exportable gas to the Russian company, the Nabucco project will receive a fatal blow, and Azerbaijan will become highly dependent on Russia to export its natural gas. This will ultimately enable Russia to gain more leverage in its relations with Azerbaijan, and Russia will hardly hesitate to use this leverage in dictating its political ambitions.

‘Absurd scenarios’

Some argue that Azerbaijan may “bribe” Russia to make her apply pressure on Armenia so that Russia forces the latter to take a more constructive position in peace talks over the Nagorno-Karabakh conflict. This scenario is totally absurd. Although Russia has a great deal of political and economic influence on Armenia, this scenario is unlikely to happen because Russia is not interested in resolving the frozen Nagorno-Karabakh conflict, contrary to official Russian statements and its role as a mediator. Instead she has always used separatist conflicts to overpower post-Soviet countries. On the other hand, Azerbaijan, under the leadership of father Aliyev, pursued a similar purpose while making oil contracts with Western companies. Along with commercial gains, Azerbaijan expected to strengthen its bargaining position against Armenia while trying to become an important partner of the West. The commercial side of the story has played out quite well, and Azerbaijan also bolstered its independence and sovereignty. However, this policy did not produce desired outcomes for Azerbaijan in terms of making Western countries exert more pressure on Armenia. For all these reasons, it would not be wise for Azerbaijan to pursue the same tactic in its dealings with Russia.

Azerbaijan has to consider all possible ramifications of signing long-term deals with Gazprom and granting all its possible exportable gas to the Russian company. Azerbaijan should never be willing to experience what Turkmenistan experienced in its dealings with Gazprom. Gazprom’s unilateral reduction — at short notice — of the gas that it takes from Turkmenistan showed that Gazprom is far from being reliable and has the potential to carry out irresponsible actions. Along with Gazprom’s credibility, commercial viability and geopolitical implications of the agreement should be carefully analyzed given Gazprom’s stature as a reliable and a credible gas buyer. Having vast natural sources is not enough. The wise management of those sources is much more important.

Leave a Reply